Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth depends on it. Regardless of the various methods used by elite investors like David Tepper and Dan Loeb, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

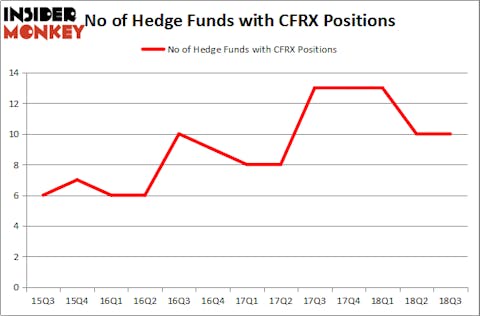

ContraFect Corp (NASDAQ:CFRX) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 10 hedge funds’ portfolios at the end of September. At the end of this article we will also compare CFRX to other stocks including Franklin Universal Trust (NYSE:FT), Mediwound Ltd (NASDAQ:MDWD), and Nature’s Sunshine Prod. (NASDAQ:NATR) to get a better sense of its popularity.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s check out the new hedge fund action surrounding ContraFect Corp (NASDAQ:CFRX).

What have hedge funds been doing with ContraFect Corp (NASDAQ:CFRX)?

At Q3’s end, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, no change from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CFRX over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Baker Bros. Advisors was the largest shareholder of ContraFect Corp (NASDAQ:CFRX), with a stake worth $14.8 million reported as of the end of September. Trailing Baker Bros. Advisors was Biotechnology Value Fund / BVF Inc, which amassed a stake valued at $7.2 million. Adage Capital Management, Cormorant Asset Management, and 683 Capital Partners were also very fond of the stock, giving the stock large weights in their portfolios.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s also examine hedge fund activity in other stocks similar to ContraFect Corp (NASDAQ:CFRX). We will take a look at Franklin Universal Trust (NYSE:FT), Mediwound Ltd (NASDAQ:MDWD), Nature’s Sunshine Prod. (NASDAQ:NATR), and CB Financial Services, Inc. (NASDAQ:CBFV). This group of stocks’ market values resemble CFRX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FT | 2 | 324 | 0 |

| MDWD | 3 | 2483 | -2 |

| NATR | 6 | 68029 | 0 |

| CBFV | 2 | 1768 | -1 |

| Average | 3.25 | 18151 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 3.25 hedge funds with bullish positions and the average amount invested in these stocks was $18 million. That figure was $42 million in CFRX’s case. Nature’s Sunshine Prod. (NASDAQ:NATR) is the most popular stock in this table. On the other hand Franklin Universal Trust (NYSE:FT) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks ContraFect Corp (NASDAQ:CFRX) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.