We are still in an overall bull market and many stocks that smart money investors were piling into surged through the end of November. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 54% and 51% respectively. Hedge funds’ top 3 stock picks returned 41.7% this year and beat the S&P 500 ETFs by 14 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Community Health Systems, Inc. (NYSE:CYH).

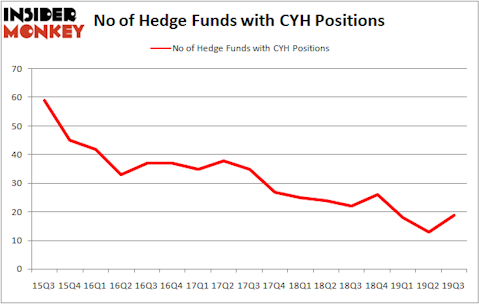

Is Community Health Systems, Inc. (NYSE:CYH) a bargain? Investors who are in the know are taking a bullish view. The number of long hedge fund bets moved up by 6 recently. Our calculations also showed that CYH isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). CYH was in 19 hedge funds’ portfolios at the end of the third quarter of 2019. There were 13 hedge funds in our database with CYH positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Kamran Moghtaderi of Eversept Partners

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a peek at the new hedge fund action surrounding Community Health Systems, Inc. (NYSE:CYH).

How are hedge funds trading Community Health Systems, Inc. (NYSE:CYH)?

At the end of the third quarter, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 46% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CYH over the last 17 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Saba Capital, managed by Boaz Weinstein, holds the number one position in Community Health Systems, Inc. (NYSE:CYH). Saba Capital has a $20.6 million position in the stock, comprising 1% of its 13F portfolio. On Saba Capital’s heels is Elliott Management, managed by Paul Singer, which holds a $16.2 million position; 0.1% of its 13F portfolio is allocated to the company. Other professional money managers that hold long positions include Chuck Royce’s Royce & Associates, Jeffrey Altman’s Owl Creek Asset Management and Paul Marshall and Ian Wace’s Marshall Wace. In terms of the portfolio weights assigned to each position Saba Capital allocated the biggest weight to Community Health Systems, Inc. (NYSE:CYH), around 0.95% of its 13F portfolio. Eversept Partners is also relatively very bullish on the stock, dishing out 0.68 percent of its 13F equity portfolio to CYH.

As industrywide interest jumped, specific money managers were breaking ground themselves. Marshall Wace, managed by Paul Marshall and Ian Wace, established the most outsized position in Community Health Systems, Inc. (NYSE:CYH). Marshall Wace had $2.7 million invested in the company at the end of the quarter. Kamran Moghtaderi’s Eversept Partners also initiated a $2.2 million position during the quarter. The other funds with new positions in the stock are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Andy Redleaf’s Whitebox Advisors, and Michael Gelband’s ExodusPoint Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Community Health Systems, Inc. (NYSE:CYH) but similarly valued. We will take a look at PDF Solutions, Inc. (NASDAQ:PDFS), Clean Energy Fuels Corp (NASDAQ:CLNE), Donnelley Financial Solutions, Inc. (NYSE:DFIN), and Jianpu Technology Inc. (NYSE:JT). This group of stocks’ market values match CYH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PDFS | 11 | 22936 | 3 |

| CLNE | 10 | 22186 | 2 |

| DFIN | 13 | 49425 | 1 |

| JT | 5 | 24532 | 1 |

| Average | 9.75 | 29770 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.75 hedge funds with bullish positions and the average amount invested in these stocks was $30 million. That figure was $64 million in CYH’s case. Donnelley Financial Solutions, Inc. (NYSE:DFIN) is the most popular stock in this table. On the other hand Jianpu Technology Inc. (NYSE:JT) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Community Health Systems, Inc. (NYSE:CYH) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately CYH wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CYH were disappointed as the stock returned -11.1% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.