The financial regulations require hedge funds and wealthy investors that crossed the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on June 28th. We at Insider Monkey have made an extensive database of nearly 750 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Colgate-Palmolive Company (NYSE:CL) based on those filings.

Hedge fund interest in Colgate-Palmolive Company (NYSE:CL) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that CME isn’t among the 30 most popular stocks among hedge funds (see the video at the end of this article). At the end of this article we will also compare CL to other stocks including Dominion Energy, Inc. (NYSE:D), Mitsubishi UFJ Financial Group, Inc. (NYSE:MUFG), and CIGNA Corporation (NYSE:CI) to get a better sense of its popularity.

According to most market participants, hedge funds are seen as slow, old financial vehicles of years past. While there are more than 8000 funds with their doors open today, We hone in on the leaders of this club, about 750 funds. It is estimated that this group of investors control bulk of the hedge fund industry’s total asset base, and by observing their first-class equity investments, Insider Monkey has uncovered several investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the recent hedge fund action regarding Colgate-Palmolive Company (NYSE:CL).

How have hedgies been trading Colgate-Palmolive Company (NYSE:CL)?

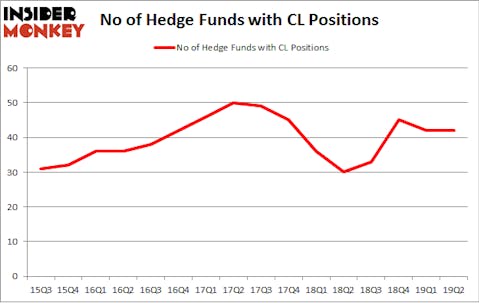

At Q2’s end, a total of 42 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in CL over the last 16 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, D. E. Shaw’s D E Shaw has the biggest position in Colgate-Palmolive Company (NYSE:CL), worth close to $419.5 million, corresponding to 0.5% of its total 13F portfolio. On D E Shaw’s heels is Renaissance Technologies, managed by Jim Simons, which holds a $350.4 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Some other peers with similar optimism encompass Cliff Asness’s AQR Capital Management, John Overdeck and David Siegel’s Two Sigma Advisors and Panayotis Takis Sparaggis’s Alkeon Capital Management.

Because Colgate-Palmolive Company (NYSE:CL) has faced a decline in interest from the aggregate hedge fund industry, it’s easy to see that there is a sect of hedgies that slashed their entire stakes in the second quarter. Intriguingly, David Blood and Al Gore’s Generation Investment Management dropped the largest stake of all the hedgies tracked by Insider Monkey, totaling close to $91.6 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund dumped about $23.5 million worth. These transactions are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to Colgate-Palmolive Company (NYSE:CL). These stocks are Dominion Energy, Inc. (NYSE:D), Mitsubishi UFJ Financial Group, Inc. (NYSE:MUFG), CIGNA Corporation (NYSE:CI), and Intuitive Surgical, Inc. (NASDAQ:ISRG). All of these stocks’ market caps resemble CL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| D | 39 | 1228250 | 3 |

| MUFG | 12 | 65234 | -2 |

| CI | 48 | 2664032 | 1 |

| ISRG | 37 | 994131 | -3 |

| Average | 34 | 1237912 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34 hedge funds with bullish positions and the average amount invested in these stocks was $1238 million. That figure was $1858 million in CL’s case. CIGNA Corporation (NYSE:CI) is the most popular stock in this table. On the other hand Mitsubishi UFJ Financial Group, Inc. (NYSE:MUFG) is the least popular one with only 12 bullish hedge fund positions. Colgate-Palmolive Company (NYSE:CL) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on CL, though not to the same extent, as the stock returned 3.2% during the third quarter and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.