It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 20 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated an outperformance of more than 8 percentage points so far in 2019. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in CNX Resources Corporation (NYSE:CNX).

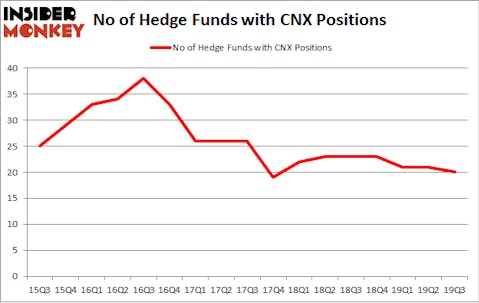

Is CNX Resources Corporation (NYSE:CNX) a buy right now? The smart money is becoming less confident. The number of long hedge fund positions were trimmed by 1 recently. Our calculations also showed that CNX isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). CNX was in 20 hedge funds’ portfolios at the end of September. There were 21 hedge funds in our database with CNX holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are a lot of methods market participants put to use to evaluate publicly traded companies. A couple of the most under-the-radar methods are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the best fund managers can outclass their index-focused peers by a superb margin (see the details here).

Mason Hawkins of Southeastern Asset Management

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a glance at the key hedge fund action encompassing CNX Resources Corporation (NYSE:CNX).

How have hedgies been trading CNX Resources Corporation (NYSE:CNX)?

At Q3’s end, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, a change of -5% from the second quarter of 2019. By comparison, 23 hedge funds held shares or bullish call options in CNX a year ago. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

The largest stake in CNX Resources Corporation (NYSE:CNX) was held by Southeastern Asset Management, which reported holding $389.7 million worth of stock at the end of September. It was followed by Greenlight Capital with a $42.7 million position. Other investors bullish on the company included AQR Capital Management, Millennium Management, and Arrowstreet Capital. In terms of the portfolio weights assigned to each position Southeastern Asset Management allocated the biggest weight to CNX Resources Corporation (NYSE:CNX), around 6.8% of its 13F portfolio. Greenlight Capital is also relatively very bullish on the stock, dishing out 3.07 percent of its 13F equity portfolio to CNX.

Because CNX Resources Corporation (NYSE:CNX) has faced bearish sentiment from the aggregate hedge fund industry, it’s easy to see that there is a sect of money managers that slashed their positions entirely last quarter. Intriguingly, Todd J. Kantor’s Encompass Capital Advisors cut the largest stake of all the hedgies watched by Insider Monkey, valued at an estimated $1.5 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also dumped its stock, about $0.6 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest dropped by 1 funds last quarter.

Let’s check out hedge fund activity in other stocks similar to CNX Resources Corporation (NYSE:CNX). These stocks are Bed Bath & Beyond Inc. (NASDAQ:BBBY), Actuant Corporation (NYSE:ATU), Sonic Automotive Inc (NYSE:SAH), and Qiwi PLC (NASDAQ:QIWI). This group of stocks’ market caps resemble CNX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BBBY | 23 | 161773 | 3 |

| ATU | 10 | 257177 | -2 |

| SAH | 12 | 39925 | 1 |

| QIWI | 13 | 105061 | 0 |

| Average | 14.5 | 140984 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.5 hedge funds with bullish positions and the average amount invested in these stocks was $141 million. That figure was $528 million in CNX’s case. Bed Bath & Beyond Inc. (NASDAQ:BBBY) is the most popular stock in this table. On the other hand Actuant Corporation (NYSE:ATU) is the least popular one with only 10 bullish hedge fund positions. CNX Resources Corporation (NYSE:CNX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately CNX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CNX were disappointed as the stock returned -4.8% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.