Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track more than 700 prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile gigantic failures like hedge funds’ recent losses in Valeant. Let’s take a closer look at what the funds we track think about Citizens Financial Group Inc (NYSE:CFG) in this article.

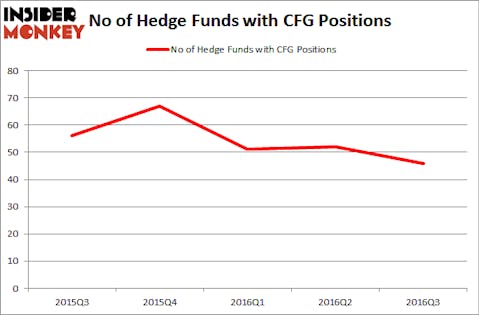

Citizens Financial Group Inc (NYSE:CFG) has seen a decrease in hedge fund interest in recent months. There were 46 funds from our database holding shares of the company at the end of September, down from 52 funds a quarter earlier. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Pentair, Ltd. Registered Share (NYSE:PNR), Cintas Corporation (NASDAQ:CTAS), and Hasbro, Inc. (NASDAQ:HAS) to gather more data points.

Follow Citizens Financial Group Inc (NYSE:CFG)

Follow Citizens Financial Group Inc (NYSE:CFG)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Zadorozhnyi Viktor/Shutterstock.com

Keeping this in mind, we’re going to take a glance at the recent action surrounding Citizens Financial Group Inc (NYSE:CFG).

What have hedge funds been doing with Citizens Financial Group Inc (NYSE:CFG)?

As stated earlier, 46 funds tracked by Insider Monkey held long positions in Citizens Financial Group, down by 12% from the previous quarter. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Point State Capital, managed by Zach Schreiber, holds the number one position in Citizens Financial Group Inc (NYSE:CFG). Point State Capital has a $142.3 million position in the stock, comprising 1.5% of its 13F portfolio. The second most bullish fund is Cliff Asness’ AQR Capital Management, with a $88.8 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other professional money managers that are bullish consist of Anthony Bozza’s Lakewood Capital Management, Michael Blitzer’s Kingstown Capital Management, and Matthew Lindenbaum’s Basswood Capital.

Seeing as Citizens Financial Group Inc (NYSE:CFG) has faced declining sentiment from the entirety of the hedge funds we track, logic holds that there was a specific group of fund managers that decided to sell off their entire stakes last quarter. Intriguingly, John Overdeck and David Siegel’s Two Sigma Advisors cut the largest stake of all the hedgies monitored by Insider Monkey, worth close to $34.8 million in stock, and Anand Parekh’s Alyeska Investment Group was right behind this move, as the fund cut about $28.6 million worth of shares.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Citizens Financial Group Inc (NYSE:CFG) but similarly valued. These stocks are Pentair, Ltd. Registered Share (NYSE:PNR), Cintas Corporation (NASDAQ:CTAS), Hasbro, Inc. (NASDAQ:HAS), and Harris Corporation (NYSE:HRS). All of these stocks’ market caps resemble CFG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PNR | 18 | 1032360 | -5 |

| CTAS | 33 | 587766 | 6 |

| HAS | 22 | 312734 | -4 |

| HRS | 22 | 476297 | 1 |

As you can see these stocks had an average of 24 investors with long positions and the average amount invested in these stocks was $602 million. That figure was $1.11 billion in CFG’s case. Cintas Corporation (NASDAQ:CTAS) is the most popular stock in this table with 33 funds holding shares. On the other hand, Pentair, Ltd. Registered Share (NYSE:PNR) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Citizens Financial Group Inc (NYSE:CFG) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.