Is Cision Ltd. (NYSE:CISN) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy league graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

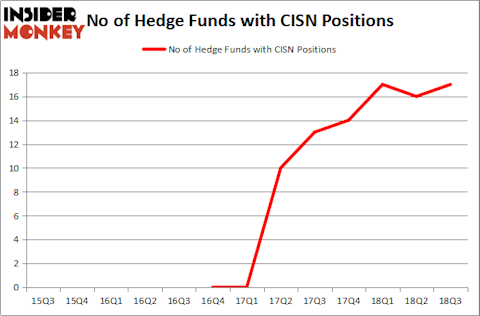

Cision Ltd. (NYSE:CISN) has seen an increase in hedge fund interest lately. CISN was in 17 hedge funds’ portfolios at the end of the third quarter of 2018. There were 16 hedge funds in our database with CISN positions at the end of the previous quarter. Our calculations also showed that CISN isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are numerous signals stock traders employ to size up publicly traded companies. A couple of the most innovative signals are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the best investment managers can outpace the market by a solid margin (see the details here).

Let’s take a look at the latest hedge fund action surrounding Cision Ltd. (NYSE:CISN).

What have hedge funds been doing with Cision Ltd. (NYSE:CISN)?

At Q3’s end, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CISN over the last 13 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

More specifically, Pennant Capital Management was the largest shareholder of Cision Ltd. (NYSE:CISN), with a stake worth $39.7 million reported as of the end of September. Trailing Pennant Capital Management was Steadfast Capital Management, which amassed a stake valued at $15.8 million. First Pacific Advisors LLC, Spitfire Capital, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, specific money managers have jumped into Cision Ltd. (NYSE:CISN) headfirst. Millennium Management, managed by Israel Englander, initiated the most valuable position in Cision Ltd. (NYSE:CISN). Millennium Management had $7.4 million invested in the company at the end of the quarter. Ira Unschuld’s Brant Point Investment Management also initiated a $3.7 million position during the quarter. The following funds were also among the new CISN investors: Matthew Hulsizer’s PEAK6 Capital Management and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Cision Ltd. (NYSE:CISN) but similarly valued. We will take a look at CONMED Corporation (NASDAQ:CNMD), Evolent Health Inc (NYSE:EVH), Finisar Corporation (NASDAQ:FNSR), and First Merchants Corporation (NASDAQ:FRME). This group of stocks’ market values are closest to CISN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CNMD | 21 | 228787 | 3 |

| EVH | 13 | 138711 | -2 |

| FNSR | 13 | 119514 | 2 |

| FRME | 13 | 152575 | 0 |

| Average | 15 | 159897 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $160 million. That figure was $135 million in CISN’s case. CONMED Corporation (NASDAQ:CNMD) is the most popular stock in this table. On the other hand Evolent Health Inc (NYSE:EVH) is the least popular one with only 13 bullish hedge fund positions. Cision Ltd. (NYSE:CISN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CNMD might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.