Before we spend many hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. We would like to do so because the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Cheniere Energy, Inc. (NYSEAMEX:LNG).

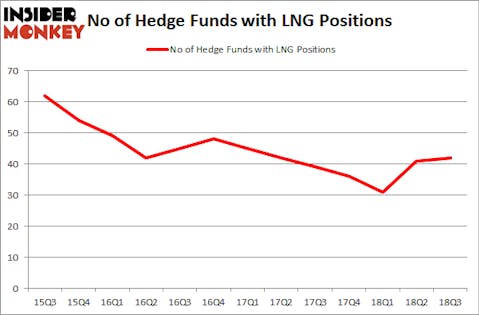

Cheniere Energy, Inc. (NYSEAMEX:LNG) investors should be aware of an increase in hedge fund interest of late. LNG was in 42 hedge funds’ portfolios at the end of September. There were 41 hedge funds in our database with LNG holdings at the end of the previous quarter. Our calculations also showed that LNG isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a gander at the latest hedge fund action regarding Cheniere Energy, Inc. (NYSEAMEX:LNG).

How have hedgies been trading Cheniere Energy, Inc. (NYSEAMEX:LNG)?

At the end of the third quarter, a total of 42 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 2% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards LNG over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Carl Icahn’s Icahn Capital LP has the most valuable position in Cheniere Energy, Inc. (NYSEAMEX:LNG), worth close to $1.6247 billion, accounting for 6.4% of its total 13F portfolio. Coming in second is Seth Klarman of Baupost Group, with a $986.5 million position; the fund has 7.6% of its 13F portfolio invested in the stock. Other peers with similar optimism encompass Michael Lowenstein’s Kensico Capital, Kevin Michael Ulrich and Anthony Davis’s Anchorage Advisors and PVH’s Zimmer Partners.

With a general bullishness amongst the heavyweights, specific money managers have been driving this bullishness. Viking Global, managed by Andreas Halvorsen, created the most valuable position in Cheniere Energy, Inc. (NYSEAMEX:LNG). Viking Global had $41 million invested in the company at the end of the quarter. Gifford Combs’s Dalton Investments also initiated a $14 million position during the quarter. The other funds with brand new LNG positions are Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, Charles Lemonides’s Valueworks LLC, and Kevin D. Eng’s Columbus Hill Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Cheniere Energy, Inc. (NYSEAMEX:LNG). We will take a look at Magna International Inc. (NYSE:MGA), Credicorp Ltd. (NYSE:BAP), Textron Inc. (NYSE:TXT), and SK Telecom Co., Ltd. (NYSE:SKM). This group of stocks’ market caps are similar to LNG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MGA | 20 | 413773 | -4 |

| BAP | 15 | 824239 | 0 |

| TXT | 26 | 596915 | 1 |

| SKM | 5 | 40078 | -1 |

| Average | 16.5 | 468751 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $469 million. That figure was $5.97 billion in LNG’s case. Textron Inc. (NYSE:TXT) is the most popular stock in this table. On the other hand SK Telecom Co., Ltd. (NYSE:SKM) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Cheniere Energy, Inc. (NYSEAMEX:LNG) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.