A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on ChemoCentryx Inc (NASDAQ:CCXI).

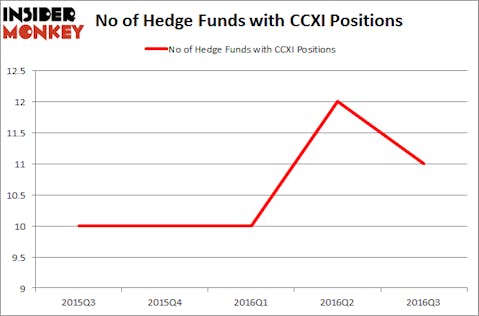

ChemoCentryx Inc (NASDAQ:CCXI) has seen a decrease in hedge fund interest recently. CCXI was in 11 hedge funds’ portfolios at the end of the third quarter of 2016. There were 12 hedge funds in our database with CCXI positions at the end of the second quarter. At the end of this article we will also compare CCXI to other stocks including Nutraceutical Int’l Corp. (NASDAQ:NUTR), Control4 Corp (NASDAQ:CTRL), and ASA Gold and Precious Metals Ltd (NYSE:ASA) to get a better sense of its popularity.

Follow Chemocentryx Inc. (NASDAQ:CCXI)

Follow Chemocentryx Inc. (NASDAQ:CCXI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Pressmaster/Shutterstock.com

What does the smart money think about ChemoCentryx Inc (NASDAQ:CCXI)?

At the end of the third quarter, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, an 8% drop from the previous quarter. By comparison, 10 hedge funds held shares or bullish call options in CCXI heading into this year, so hedge fund sentiment is still positive in 2016. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Biotechnology Value Fund, led by Mark Lampert, holds the biggest position in ChemoCentryx Inc (NASDAQ:CCXI). Biotechnology Value Fund has a $48.7 million position in the stock, comprising 9.2% of its 13F portfolio. Coming in second is Michael Castor of Sio Capital, with a $3.7 million position; 2.6% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors that are bullish contain Wilmot B. Harkey and Daniel Mack’s Nantahala Capital Management, Renaissance Technologies, one of the largest hedge funds in the world, and David E. Shaw’s D E Shaw. We should note that Nantahala Capital Management is among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

Since ChemoCentryx Inc (NASDAQ:CCXI) has faced a decline in interest from the smart money, we can see that there is a sect of hedge funds who sold off their full holdings in the third quarter. At the top of the heap, Rob Romero’s Connective Capital Management dumped the biggest position of all the investors studied by Insider Monkey, comprising an estimated $0.9 million in stock, and Ken Griffin’s Citadel Investment Group was right behind this move, as the fund said goodbye to about $0.3 million worth of shares.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as ChemoCentryx Inc (NASDAQ:CCXI) but similarly valued. These stocks are Nutraceutical Int’l Corp. (NASDAQ:NUTR), Control4 Corp (NASDAQ:CTRL), ASA Gold and Precious Metals Ltd (NYSE:ASA), and Ascent Capital Group Inc (NASDAQ:ASCMA). This group of stocks’ market caps are similar to CCXI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NUTR | 4 | 24796 | -1 |

| CTRL | 12 | 39487 | 2 |

| ASA | 4 | 19661 | 4 |

| ASCMA | 14 | 100266 | 2 |

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $46 million. That figure was $60 million in CCXI’s case. Ascent Capital Group Inc (NASDAQ:ASCMA) is the most popular stock in this table. On the other hand Nutraceutical Int’l Corp. (NASDAQ:NUTR) is the least popular one with only 4 bullish hedge fund positions. ChemoCentryx Inc (NASDAQ:CCXI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ASCMA might be a better candidate to consider taking a long position in.

Disclosure: None