World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

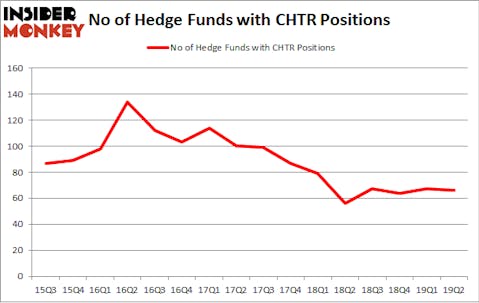

Is Charter Communications, Inc. (NASDAQ:CHTR) going to take off soon? Investors who are in the know are in a relatively pessimistic mood. The number of long hedge fund bets were trimmed by 1 in recent months. Hedge fund sentiment towards the stock is 50% below its 2016 peak when the stock was wildly popular. Our calculations also showed that CHTR isn’t among the 30 most popular stocks among hedge funds. However, this doesn’t necessarily mean that hedge funds are actually bearish about CHTR.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to go over the fresh hedge fund action surrounding Charter Communications, Inc. (NASDAQ:CHTR).

What have hedge funds been doing with Charter Communications, Inc. (NASDAQ:CHTR)?

At the end of the second quarter, a total of 66 of the hedge funds tracked by Insider Monkey were long this stock, a change of -1% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CHTR over the last 16 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Charter Communications, Inc. (NASDAQ:CHTR) was held by Berkshire Hathaway, which reported holding $2144.5 million worth of stock at the end of March. It was followed by Egerton Capital Limited with a $1141.9 million position. Other investors bullish on the company included First Pacific Advisors LLC, AltaRock Partners, and Deccan Value Advisors.

Since Charter Communications, Inc. (NASDAQ:CHTR) has faced a decline in interest from the aggregate hedge fund industry, logic holds that there exists a select few funds who sold off their full holdings heading into Q3. Intriguingly, Jonathon Jacobson’s Highfields Capital Management dropped the largest investment of the “upper crust” of funds monitored by Insider Monkey, valued at an estimated $128.4 million in stock, and Gil Simon’s SoMa Equity Partners was right behind this move, as the fund sold off about $52 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest dropped by 1 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Charter Communications, Inc. (NASDAQ:CHTR) but similarly valued. We will take a look at Banco Santander (Brasil) SA (NYSE:BSBR), United Parcel Service, Inc. (NYSE:UPS), Gilead Sciences, Inc. (NASDAQ:GILD), and U.S. Bancorp (NYSE:USB). All of these stocks’ market caps are closest to CHTR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BSBR | 11 | 179610 | 1 |

| UPS | 36 | 1051684 | -1 |

| GILD | 57 | 3863121 | -1 |

| USB | 39 | 7777146 | -5 |

| Average | 35.75 | 3217890 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.75 hedge funds with bullish positions and the average amount invested in these stocks was $3218 million. That figure was $7511 million in CHTR’s case. Gilead Sciences, Inc. (NASDAQ:GILD) is the most popular stock in this table. On the other hand Banco Santander (Brasil) SA (NYSE:BSBR) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Charter Communications, Inc. (NASDAQ:CHTR) is more popular among hedge funds which is bullish sign. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on CHTR, though not to the same extent, as the stock returned 4.3% during the third quarter and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.