Insider Monkey finished processing more than 700 13F filings made by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of September 30. In this article we are going to take a look at the smart money sentiment towards Charles Schwab Corp (NYSE:SCHW).

Charles Schwab Corp (NYSE:SCHW) has seen an increase in enthusiasm from smart money in recent months. At the end of this article we will also compare SCHW to other stocks including Korea Electric Power Corporation (ADR) (NYSE:KEP), Constellation Brands, Inc. (NYSE:STZ), and Twenty-First Century Fox Inc (NASDAQ:FOXA) to get a better sense of its popularity.

Follow Schwab Charles Corp (NYSE:SCHW)

Follow Schwab Charles Corp (NYSE:SCHW)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Brian A Jackson/Shutterstock.com

Now, let’s review the new action encompassing Charles Schwab Corp (NYSE:SCHW).

How have hedgies been trading Charles Schwab Corp (NYSE:SCHW)?

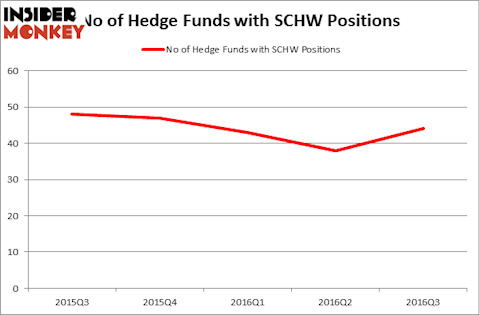

At the end of September, 44 funds tracked by Insider Monkey held long positions in Charles Schwab Corp, which represents an increase of 16% from the previous quarter. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, John H. Scully’s SPO Advisory Corp has the biggest position in Charles Schwab Corp (NYSE:SCHW), worth close to $591.3 million, amounting to 10.4% of its total 13F portfolio. Coming in second is Theleme Partners, led by Patrick Degorce, holding a $418.5 million position; the fund has 30.2% of its 13F portfolio invested in the stock. Remaining peers that are bullish include Lou Simpson’s SQ Advisors, John Armitage’s Egerton Capital Limited, and Glenn Greenberg’s Brave Warrior Capital.

As aggregate interest increased, specific money managers were breaking ground themselves. Tourbillon Capital Partners, managed by Jason Karp, assembled the biggest position in Charles Schwab Corp (NYSE:SCHW). Tourbillon Capital Partners had $55.2 million invested in the company at the end of the quarter. The following funds were also among the new SCHW investors: Ken Griffin’s Citadel Investment Group, James Dondero’s Highland Capital Management, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s now review hedge fund activity in other stocks similar to Charles Schwab Corp (NYSE:SCHW). These stocks are Korea Electric Power Corporation (ADR) (NYSE:KEP), Constellation Brands, Inc. (NYSE:STZ), Twenty-First Century Fox Inc (NASDAQ:FOXA), and CME Group Inc (NASDAQ:CME). All of these stocks’ market caps resemble SCHW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KEP | 14 | 125755 | 1 |

| STZ | 67 | 6679779 | -2 |

| FOXA | 48 | 3558064 | -1 |

| CME | 48 | 980224 | -1 |

As you can see these stocks had an average of 44 funds with bullish positions at the end of September and the average amount invested in these stocks was $2.84 billion. That figure was $2.68 billion in SCHW’s case. Constellation Brands, Inc. (NYSE:STZ) is the most popular stock in this table, while Korea Electric Power Corporation (ADR) (NYSE:KEP) is the least popular one with only 14 funds positions. Charles Schwab Corp (NYSE:SCHW) is not the least popular stock in this group, but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard, Constellation Brands, Inc. (NYSE:STZ) might be a better candidate to consider a long position.