Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant out-performance. These stocks have been on a tear since the end of June, outperforming large-cap index funds by more than 10 percentage points. That’s why we pay special attention to hedge fund activity in these stocks.

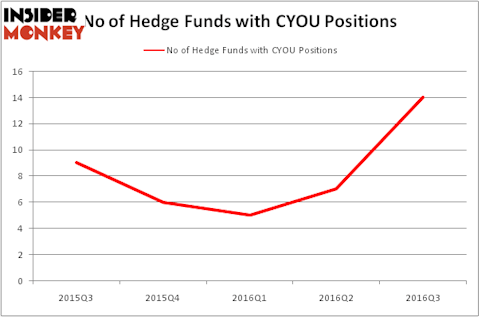

Changyou.Com Ltd (ADR) (NASDAQ:CYOU) investors should be aware of an increase in hedge fund interest in recent months. There were 7 hedge funds in our database with CYOU holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Ring Energy Inc (NYSEMKT:REI), THL Credit, Inc. (NASDAQ:TCRD), and Arbor Realty Trust, Inc. (NYSE:ABR) to gather more data points.

Follow Changyou Com Ltd (NASDAQ:CYOU)

Follow Changyou Com Ltd (NASDAQ:CYOU)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Przemek Tokar / Shutterstock.com

With all of this in mind, we’re going to view the latest action encompassing Changyou.Com Ltd (ADR) (NASDAQ:CYOU).

Hedge fund activity in Changyou.Com Ltd (ADR) (NASDAQ:CYOU)

Heading into the fourth quarter of 2016, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of 100% from the previous quarter. By comparison, 6 hedge funds held shares or bullish call options in CYOU heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Jim Simons’s Renaissance Technologies has the biggest position in Changyou.Com Ltd (ADR) (NASDAQ:CYOU), worth close to $14.6 million, corresponding to less than 0.1%% of its total 13F portfolio. Sitting at the No. 2 spot is Rob Citrone of Discovery Capital Management, with a $14 million position; 0.3% of its 13F portfolio is allocated to the stock. Some other professional money managers with similar optimism contain Ernest Chow and Jonathan Howe’s Sensato Capital Management, Yi Xin’s Ariose Capital and D E Shaw. We should note that Sensato Capital Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

With a general bullishness amongst the heavyweights, key money managers were breaking ground themselves. Discovery Capital Management, led by Rob Citrone, assembled the biggest position in Changyou.Com Ltd (ADR) (NASDAQ:CYOU). Discovery Capital Management had $14 million invested in the company at the end of the quarter. Yi Xin’s Ariose Capital also initiated a $12.2 million position during the quarter. The other funds with brand new CYOU positions are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Israel Englander’s Millennium Management, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Changyou.Com Ltd (ADR) (NASDAQ:CYOU) but similarly valued. These stocks are Ring Energy Inc (NYSEMKT:REI), THL Credit, Inc. (NASDAQ:TCRD), Arbor Realty Trust, Inc. (NYSE:ABR), and ChannelAdvisor Corp (NYSE:ECOM). This group of stocks’ market valuations are similar to CYOU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| REI | 11 | 62613 | 3 |

| TCRD | 7 | 7707 | -2 |

| ABR | 8 | 8906 | -1 |

| ECOM | 10 | 14011 | 1 |

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $23 million. That figure was $79 million in CYOU’s case. Ring Energy Inc (NYSEMKT:REI) is the most popular stock in this table. On the other hand THL Credit, Inc. (NASDAQ:TCRD) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Changyou.Com Ltd (ADR) (NASDAQ:CYOU) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.