We are still in an overall bull market and many stocks that smart money investors were piling into surged through the end of November. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 54% and 51% respectively. Hedge funds’ top 3 stock picks returned 41.7% this year and beat the S&P 500 ETFs by 14 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Century Aluminum Co (NASDAQ:CENX).

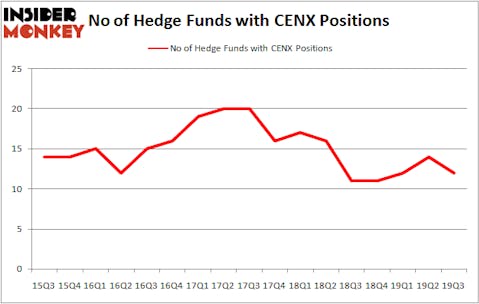

Is Century Aluminum Co (NASDAQ:CENX) the right pick for your portfolio? Hedge funds are getting less optimistic. The number of bullish hedge fund positions were trimmed by 2 in recent months. Our calculations also showed that CENX isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). CENX was in 12 hedge funds’ portfolios at the end of the third quarter of 2019. There were 14 hedge funds in our database with CENX holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s take a glance at the latest hedge fund action regarding Century Aluminum Co (NASDAQ:CENX).

How have hedgies been trading Century Aluminum Co (NASDAQ:CENX)?

Heading into the fourth quarter of 2019, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -14% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CENX over the last 17 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Ken Fisher’s Fisher Asset Management has the biggest position in Century Aluminum Co (NASDAQ:CENX), worth close to $9.1 million, accounting for less than 0.1%% of its total 13F portfolio. The second largest stake is held by Chuck Royce of Royce & Associates, with a $8 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other peers with similar optimism include Ken Griffin’s Citadel Investment Group, and Phill Gross and Robert Atchinson’s Adage Capital Management. In terms of the portfolio weights assigned to each position Lyon Street Capital allocated the biggest weight to Century Aluminum Co (NASDAQ:CENX), around 1.71% of its 13F portfolio. Royce & Associates is also relatively very bullish on the stock, setting aside 0.07 percent of its 13F equity portfolio to CENX.

Because Century Aluminum Co (NASDAQ:CENX) has experienced a decline in interest from the smart money, it’s safe to say that there were a few hedge funds who sold off their full holdings last quarter. Interestingly, Ron Gutfleish’s Elm Ridge Capital cut the largest position of the “upper crust” of funds watched by Insider Monkey, comprising an estimated $1.3 million in stock. Benjamin A. Smith’s fund, Laurion Capital Management, also sold off its stock, about $0.6 million worth. These moves are intriguing to say the least, as total hedge fund interest was cut by 2 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Century Aluminum Co (NASDAQ:CENX) but similarly valued. We will take a look at Harmonic Inc (NASDAQ:HLIT), Johnson Outdoors Inc. (NASDAQ:JOUT), Mercantile Bank Corp. (NASDAQ:MBWM), and Crossamerica Partners LP (NYSE:CAPL). All of these stocks’ market caps are closest to CENX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HLIT | 19 | 80499 | 5 |

| JOUT | 12 | 61479 | 2 |

| MBWM | 8 | 31156 | 1 |

| CAPL | 1 | 4401 | 0 |

| Average | 10 | 44384 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $44 million. That figure was $27 million in CENX’s case. Harmonic Inc (NASDAQ:HLIT) is the most popular stock in this table. On the other hand Crossamerica Partners LP (NYSE:CAPL) is the least popular one with only 1 bullish hedge fund positions. Century Aluminum Co (NASDAQ:CENX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on CENX, though not to the same extent, as the stock returned 6.2% during the first two months of the fourth quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.