At Insider Monkey, we pore over the filings of nearly 887 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of December 31st. In this article, we will use that wealth of knowledge to determine whether or not Centene Corporation (NYSE:CNC) makes for a good investment right now.

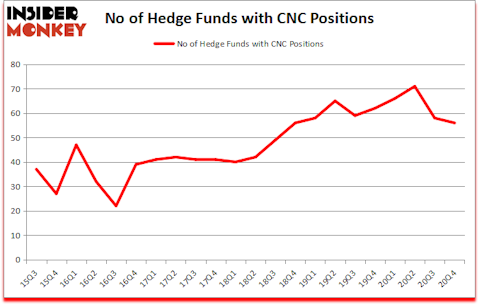

Is CNC stock a buy or sell? Centene Corporation (NYSE:CNC) investors should pay attention to a decrease in hedge fund sentiment lately. Centene Corporation (NYSE:CNC) was in 56 hedge funds’ portfolios at the end of December. The all time high for this statistic is 71. There were 58 hedge funds in our database with CNC positions at the end of the third quarter. Our calculations also showed that CNC isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

In today’s marketplace there are many tools stock market investors have at their disposal to analyze publicly traded companies. A pair of the less utilized tools are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the top investment managers can trounce the market by a significant amount (see the details here).

Andreas Halvorsen of Viking Global

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage (or at the end of this article). Keeping this in mind we’re going to check out the fresh hedge fund action surrounding Centene Corporation (NYSE:CNC).

Do Hedge Funds Think CNC Is A Good Stock To Buy Now?

At the end of December, a total of 56 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -3% from the previous quarter. By comparison, 62 hedge funds held shares or bullish call options in CNC a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

Among these funds, Viking Global held the most valuable stake in Centene Corporation (NYSE:CNC), which was worth $785.7 million at the end of the fourth quarter. On the second spot was Farallon Capital which amassed $411.2 million worth of shares. Southpoint Capital Advisors, Lyrical Asset Management, and Deerfield Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Courage Capital allocated the biggest weight to Centene Corporation (NYSE:CNC), around 4.78% of its 13F portfolio. Southpoint Capital Advisors is also relatively very bullish on the stock, setting aside 3.52 percent of its 13F equity portfolio to CNC.

Seeing as Centene Corporation (NYSE:CNC) has witnessed a decline in interest from the aggregate hedge fund industry, it’s easy to see that there were a few hedgies who sold off their entire stakes in the fourth quarter. Intriguingly, Roberto Mignone’s Bridger Management sold off the biggest stake of all the hedgies followed by Insider Monkey, comprising about $46.7 million in stock, and Alok Agrawal’s Bloom Tree Partners was right behind this move, as the fund dumped about $30 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest was cut by 2 funds in the fourth quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Centene Corporation (NYSE:CNC) but similarly valued. We will take a look at Xilinx, Inc. (NASDAQ:XLNX), Lloyds Banking Group PLC (NYSE:LYG), Barclays PLC (NYSE:BCS), eBay Inc (NASDAQ:EBAY), Lufax Holding Ltd (NYSE:LU), Manulife Financial Corporation (NYSE:MFC), and Walgreens Boots Alliance Inc (NASDAQ:WBA). All of these stocks’ market caps match CNC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XLNX | 66 | 3837083 | 20 |

| LYG | 5 | 4389 | 0 |

| BCS | 12 | 62951 | 6 |

| EBAY | 53 | 4009566 | 3 |

| LU | 11 | 209193 | 11 |

| MFC | 20 | 170455 | -1 |

| WBA | 36 | 609193 | 3 |

| Average | 29 | 1271833 | 6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29 hedge funds with bullish positions and the average amount invested in these stocks was $1272 million. That figure was $2646 million in CNC’s case. Xilinx, Inc. (NASDAQ:XLNX) is the most popular stock in this table. On the other hand Lloyds Banking Group PLC (NYSE:LYG) is the least popular one with only 5 bullish hedge fund positions. Centene Corporation (NYSE:CNC) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for CNC is 68.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 5.3% in 2021 through March 19th and still beat the market by 0.8 percentage points. Hedge funds were also right about betting on CNC as the stock returned 7% since the end of Q4 (through 3/19) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Centene Corp (NYSE:CNC)

Follow Centene Corp (NYSE:CNC)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.