Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

Is Casella Waste Systems Inc. (NASDAQ:CWST) worth your attention right now? Money managers are getting more bullish. The number of bullish hedge fund bets increased by 1 recently. Our calculations also showed that CWST isn’t among the 30 most popular stocks among hedge funds. CWST was in 16 hedge funds’ portfolios at the end of the third quarter of 2018. There were 15 hedge funds in our database with CWST positions at the end of the previous quarter.

At the moment there are many signals shareholders employ to size up publicly traded companies. A pair of the most innovative signals are hedge fund and insider trading signals. We have shown that, historically, those who follow the top picks of the top investment managers can outpace their index-focused peers by a solid amount (see the details here).

Let’s take a look at the new hedge fund action regarding Casella Waste Systems Inc. (NASDAQ:CWST).

How have hedgies been trading Casella Waste Systems Inc. (NASDAQ:CWST)?

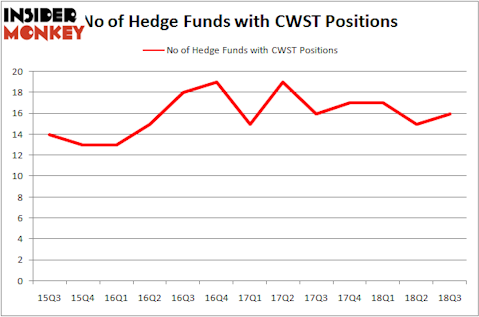

At the end of the third quarter, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from the previous quarter. The graph below displays the number of hedge funds with bullish position in CWST over the last 13 quarters. With hedge funds’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

The largest stake in Casella Waste Systems Inc. (NASDAQ:CWST) was held by Renaissance Technologies, which reported holding $106 million worth of stock at the end of September. It was followed by Portolan Capital Management with a $13.7 million position. Other investors bullish on the company included Arrowstreet Capital, Two Sigma Advisors, and Skylands Capital.

As one would reasonably expect, key hedge funds have been driving this bullishness. Impax Asset Management, managed by Ian Simm, assembled the most outsized position in Casella Waste Systems Inc. (NASDAQ:CWST). Impax Asset Management had $3.7 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also made a $0.6 million investment in the stock during the quarter. The only other fund with a new position in the stock is Frederick DiSanto’s Ancora Advisors.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Casella Waste Systems Inc. (NASDAQ:CWST) but similarly valued. We will take a look at Engility Holdings Inc (NYSE:EGL), Hecla Mining Company (NYSE:HL), MGP Ingredients Inc (NASDAQ:MGPI), and Pitney Bowes Inc. (NYSE:PBI). This group of stocks’ market caps are closest to CWST’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EGL | 17 | 61929 | 6 |

| HL | 11 | 17805 | -1 |

| MGPI | 11 | 46941 | 3 |

| PBI | 22 | 131743 | 2 |

| Average | 15.25 | 64605 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $65 million. That figure was $178 million in CWST’s case. Pitney Bowes Inc. (NYSE:PBI) is the most popular stock in this table. On the other hand Hecla Mining Company (NYSE:HL) is the least popular one with only 11 bullish hedge fund positions. Casella Waste Systems Inc. (NASDAQ:CWST) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PBI might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.