Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter. NASDAQ and Russell 2000 indices were already in correction territory. More importantly, Russell 2000 ETF (IWM) underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points in the fourth quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were paring back their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards CalAmp Corp. (NASDAQ:CAMP).

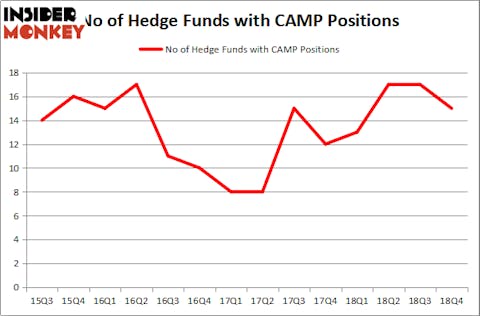

CalAmp Corp. (NASDAQ:CAMP) investors should be aware of a decrease in hedge fund interest in recent months. Our calculations also showed that CAMP isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are a lot of formulas shareholders employ to grade their stock investments. A pair of the best formulas are hedge fund and insider trading signals. We have shown that, historically, those who follow the top picks of the elite hedge fund managers can outclass the S&P 500 by a healthy amount (see the details here).

We’re going to review the fresh hedge fund action regarding CalAmp Corp. (NASDAQ:CAMP).

What have hedge funds been doing with CalAmp Corp. (NASDAQ:CAMP)?

Heading into the first quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of -12% from the previous quarter. The graph below displays the number of hedge funds with bullish position in CAMP over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the number one position in CalAmp Corp. (NASDAQ:CAMP). Renaissance Technologies has a $13.8 million position in the stock, comprising less than 0.1%% of its 13F portfolio. On Renaissance Technologies’s heels is Phil Frohlich of Prescott Group Capital Management, with a $4.9 million position; 1% of its 13F portfolio is allocated to the stock. Remaining members of the smart money that are bullish include Paul Hondros’s AlphaOne Capital Partners, Ken Griffin’s Citadel Investment Group and John Thiessen’s Vertex One Asset Management.

Due to the fact that CalAmp Corp. (NASDAQ:CAMP) has witnessed bearish sentiment from the entirety of the hedge funds we track, it’s safe to say that there was a specific group of hedgies that slashed their entire stakes in the third quarter. Interestingly, Ken Griffin’s Citadel Investment Group said goodbye to the largest position of the “upper crust” of funds monitored by Insider Monkey, comprising close to $15 million in call options. Matthew Hulsizer’s fund, PEAK6 Capital Management, also sold off its call options, about $2.3 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest dropped by 2 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as CalAmp Corp. (NASDAQ:CAMP) but similarly valued. We will take a look at UMH Properties, Inc (NYSE:UMH), NII Holdings, Inc. (NASDAQ:NIHD), Clementia Pharmaceuticals Inc. (NASDAQ:CMTA), and Innovative Industrial Properties, Inc. (NYSE:IIPR). This group of stocks’ market caps match CAMP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UMH | 8 | 13751 | -1 |

| NIHD | 18 | 117146 | 1 |

| CMTA | 12 | 216373 | 2 |

| IIPR | 8 | 18371 | 0 |

| Average | 11.5 | 91410 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.5 hedge funds with bullish positions and the average amount invested in these stocks was $91 million. That figure was $33 million in CAMP’s case. NII Holdings, Inc. (NASDAQ:NIHD) is the most popular stock in this table. On the other hand UMH Properties, Inc (NYSE:UMH) is the least popular one with only 8 bullish hedge fund positions. CalAmp Corp. (NASDAQ:CAMP) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CAMP wasn’t nearly as popular as these 15 stock and hedge funds that were betting on CAMP were disappointed as the stock returned 3.5% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.