The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Conagra Brands, Inc. (NYSE:CAG).

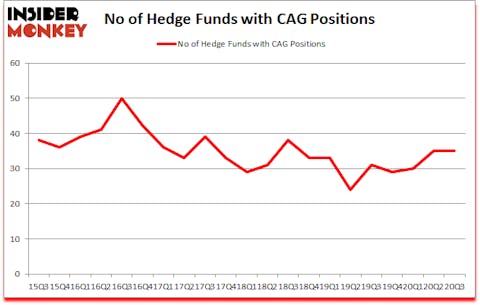

Is CAG a good stock to buy? Conagra Brands, Inc. (NYSE:CAG) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 35 hedge funds’ portfolios at the end of the third quarter of 2020. Our calculations also showed that CAG isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks). At the end of this article we will also compare CAG to other stocks including Restaurant Brands International Inc (NYSE:QSR), Canon Inc. (NYSE:CAJ), and Amcor plc (NYSE:AMCR) to get a better sense of its popularity.

Video: Watch our video about the top 5 most popular hedge fund stocks.

To most shareholders, hedge funds are perceived as unimportant, outdated financial vehicles of the past. While there are over 8000 funds trading at the moment, Our experts look at the aristocrats of this group, around 850 funds. Most estimates calculate that this group of people preside over the majority of all hedge funds’ total capital, and by shadowing their unrivaled equity investments, Insider Monkey has uncovered many investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Our portfolio of short stocks lost 13% since February 2017 (through November 17th) even though the market was up 65% during the same period. We just shared a list of 6 short targets in our latest quarterly update .

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now we’re going to go over the latest hedge fund action encompassing Conagra Brands, Inc. (NYSE:CAG).

Do Hedge Funds Think CAG Is A Good Stock To Buy Now?

At third quarter’s end, a total of 35 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CAG over the last 21 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, JANA Partners was the largest shareholder of Conagra Brands, Inc. (NYSE:CAG), with a stake worth $387.8 million reported as of the end of September. Trailing JANA Partners was Citadel Investment Group, which amassed a stake valued at $70 million. GAMCO Investors, Renaissance Technologies, and Holocene Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position JANA Partners allocated the biggest weight to Conagra Brands, Inc. (NYSE:CAG), around 34.69% of its 13F portfolio. Huber Capital Management is also relatively very bullish on the stock, designating 0.66 percent of its 13F equity portfolio to CAG.

Judging by the fact that Conagra Brands, Inc. (NYSE:CAG) has experienced declining sentiment from the smart money, it’s easy to see that there is a sect of funds who sold off their positions entirely in the third quarter. It’s worth mentioning that Alexander Mitchell’s Scopus Asset Management said goodbye to the biggest stake of the 750 funds watched by Insider Monkey, valued at about $23.7 million in stock, and Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors was right behind this move, as the fund said goodbye to about $2.9 million worth. These moves are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Conagra Brands, Inc. (NYSE:CAG) but similarly valued. We will take a look at Restaurant Brands International Inc (NYSE:QSR), Canon Inc. (NYSE:CAJ), Amcor plc (NYSE:AMCR), Deutsche Bank Aktiengesellschaft (NYSE:DB), ViacomCBS Inc. (NASDAQ:VIAC), Hologic, Inc. (NASDAQ:HOLX), and Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk (NYSE:TLK). This group of stocks’ market caps match CAG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QSR | 33 | 2742752 | -11 |

| CAJ | 7 | 52605 | -2 |

| AMCR | 18 | 238966 | 2 |

| DB | 15 | 1118364 | 4 |

| VIAC | 44 | 1249345 | -1 |

| HOLX | 50 | 1146336 | 4 |

| TLK | 8 | 133433 | 4 |

| Average | 25 | 954543 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $955 million. That figure was $770 million in CAG’s case. Hologic, Inc. (NASDAQ:HOLX) is the most popular stock in this table. On the other hand Canon Inc. (NYSE:CAJ) is the least popular one with only 7 bullish hedge fund positions. Conagra Brands, Inc. (NYSE:CAG) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for CAG is 58.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 33.3% in 2020 through December 18th and beat the market again by 16.4 percentage points. Unfortunately CAG wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CAG were disappointed as the stock returned 1.9% since the end of September (through 12/18) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Conagra Brands Inc. (NYSE:CAG)

Follow Conagra Brands Inc. (NYSE:CAG)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.