Is Bruker Corporation (NASDAQ:BRKR) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

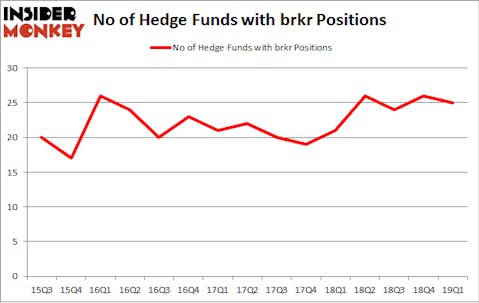

Bruker Corporation (NASDAQ:BRKR) was in 25 hedge funds’ portfolios at the end of the first quarter of 2019. BRKR investors should be aware of a decrease in hedge fund interest recently. There were 26 hedge funds in our database with BRKR positions at the end of the previous quarter. Our calculations also showed that brkr isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most market participants, hedge funds are seen as unimportant, old financial vehicles of the past. While there are over 8000 funds in operation at the moment, Our experts hone in on the moguls of this club, approximately 750 funds. These investment experts orchestrate the lion’s share of all hedge funds’ total capital, and by tailing their unrivaled equity investments, Insider Monkey has identified many investment strategies that have historically outrun the market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

Paul Marshall of Marshall Wace

Let’s go over the recent hedge fund action encompassing Bruker Corporation (NASDAQ:BRKR).

What have hedge funds been doing with Bruker Corporation (NASDAQ:BRKR)?

At the end of the first quarter, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -4% from one quarter earlier. By comparison, 21 hedge funds held shares or bullish call options in BRKR a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, D E Shaw, managed by D. E. Shaw, holds the biggest position in Bruker Corporation (NASDAQ:BRKR). D E Shaw has a $73.1 million position in the stock, comprising 0.1% of its 13F portfolio. On D E Shaw’s heels is AQR Capital Management, led by Cliff Asness, holding a $65.4 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions encompass Ken Griffin’s Citadel Investment Group, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Seeing as Bruker Corporation (NASDAQ:BRKR) has faced declining sentiment from the entirety of the hedge funds we track, logic holds that there is a sect of money managers who sold off their full holdings last quarter. Intriguingly, Simon Sadler’s Segantii Capital sold off the largest stake of the 700 funds tracked by Insider Monkey, valued at an estimated $7 million in stock. Benjamin A. Smith’s fund, Laurion Capital Management, also dropped its stock, about $1.3 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest was cut by 1 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to Bruker Corporation (NASDAQ:BRKR). We will take a look at Texas Pacific Land Trust (NYSE:TPL), CubeSmart (NYSE:CUBE), Royal Gold, Inc (NASDAQ:RGLD), and Axalta Coating Systems Ltd (NYSE:AXTA). This group of stocks’ market values are similar to BRKR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TPL | 11 | 1470997 | -2 |

| CUBE | 20 | 393248 | -2 |

| RGLD | 17 | 67145 | 2 |

| AXTA | 43 | 1962919 | 8 |

| Average | 22.75 | 973577 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.75 hedge funds with bullish positions and the average amount invested in these stocks was $974 million. That figure was $400 million in BRKR’s case. Axalta Coating Systems Ltd (NYSE:AXTA) is the most popular stock in this table. On the other hand Texas Pacific Land Trust (NYSE:TPL) is the least popular one with only 11 bullish hedge fund positions. Bruker Corporation (NASDAQ:BRKR) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on BRKR as the stock returned 7.9% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.