Is Brooks Automation, Inc. (NASDAQ:BRKS) a good bet right now? We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

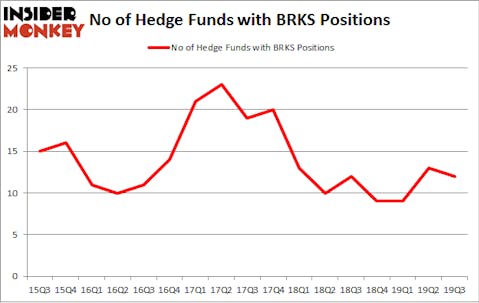

Is Brooks Automation, Inc. (NASDAQ:BRKS) an exceptional investment now? Hedge funds are taking a pessimistic view. The number of long hedge fund bets shrunk by 1 in recent months. Our calculations also showed that BRKS isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are numerous gauges shareholders can use to evaluate stocks. A couple of the less utilized gauges are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the best picks of the top hedge fund managers can outclass the broader indices by a significant amount (see the details here).

Chuck Royce of Royce & Associates

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s review the fresh hedge fund action encompassing Brooks Automation, Inc. (NASDAQ:BRKS).

Hedge fund activity in Brooks Automation, Inc. (NASDAQ:BRKS)

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -8% from the previous quarter. On the other hand, there were a total of 12 hedge funds with a bullish position in BRKS a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

More specifically, Fisher Asset Management was the largest shareholder of Brooks Automation, Inc. (NASDAQ:BRKS), with a stake worth $50.2 million reported as of the end of September. Trailing Fisher Asset Management was Royce & Associates, which amassed a stake valued at $44.5 million. Tower House Partners, Millennium Management, and SG Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Tower House Partners allocated the biggest weight to Brooks Automation, Inc. (NASDAQ:BRKS), around 27.77% of its 13F portfolio. Voce Capital is also relatively very bullish on the stock, designating 1.44 percent of its 13F equity portfolio to BRKS.

Seeing as Brooks Automation, Inc. (NASDAQ:BRKS) has experienced a decline in interest from the entirety of the hedge funds we track, we can see that there was a specific group of hedgies that decided to sell off their entire stakes heading into Q4. It’s worth mentioning that Efrem Kamen’s Pura Vida Investments cut the biggest investment of all the hedgies tracked by Insider Monkey, worth an estimated $3.7 million in stock, and David Harding’s Winton Capital Management was right behind this move, as the fund said goodbye to about $3.1 million worth. These moves are important to note, as aggregate hedge fund interest fell by 1 funds heading into Q4.

Let’s now take a look at hedge fund activity in other stocks similar to Brooks Automation, Inc. (NASDAQ:BRKS). These stocks are Brandywine Realty Trust (NYSE:BDN), M.D.C. Holdings, Inc. (NYSE:MDC), Industrias Bachoco, S.A.B. de C.V. (NYSE:IBA), and Holly Energy Partners, L.P. (NYSE:HEP). This group of stocks’ market caps match BRKS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BDN | 17 | 121356 | 3 |

| MDC | 17 | 114744 | 0 |

| IBA | 4 | 42960 | 1 |

| HEP | 6 | 14765 | 5 |

| Average | 11 | 73456 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $73 million. That figure was $153 million in BRKS’s case. Brandywine Realty Trust (NYSE:BDN) is the most popular stock in this table. On the other hand Industrias Bachoco, S.A.B. de C.V. (NYSE:IBA) is the least popular one with only 4 bullish hedge fund positions. Brooks Automation, Inc. (NASDAQ:BRKS) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on BRKS as the stock returned 20.9% during the fourth quarter (through the end of November) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.