You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

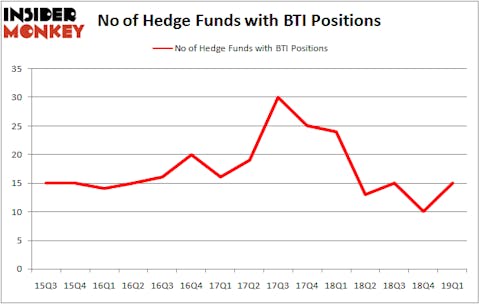

Is British American Tobacco plc (NYSE:BTI) a great investment right now? Money managers are becoming hopeful. The number of long hedge fund positions inched up by 5 lately. Our calculations also showed that BTI isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are dozens of metrics stock traders employ to analyze their holdings. A duo of the best metrics are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the top investment managers can trounce the S&P 500 by a superb amount (see the details here).

We’re going to take a gander at the new hedge fund action regarding British American Tobacco plc (NYSE:BTI).

How are hedge funds trading British American Tobacco plc (NYSE:BTI)?

At the end of the first quarter, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 50% from the fourth quarter of 2018. On the other hand, there were a total of 24 hedge funds with a bullish position in BTI a year ago. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital has the biggest position in British American Tobacco plc (NYSE:BTI), worth close to $108.9 million, accounting for 0.3% of its total 13F portfolio. Coming in second is Maverick Capital, managed by Lee Ainslie, which holds a $96.3 million position; 1.3% of its 13F portfolio is allocated to the stock. Some other peers with similar optimism consist of Ken Griffin’s Citadel Investment Group, Paul Marshall and Ian Wace’s Marshall Wace LLP and D. E. Shaw’s D E Shaw.

Now, key hedge funds have been driving this bullishness. Orbis Investment Management, managed by William B. Gray, created the largest position in British American Tobacco plc (NYSE:BTI). Orbis Investment Management had $17.3 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $6.6 million investment in the stock during the quarter. The following funds were also among the new BTI investors: Israel Englander’s Millennium Management, Michael Gelband’s ExodusPoint Capital, and Mike Vranos’s Ellington.

Let’s now take a look at hedge fund activity in other stocks similar to British American Tobacco plc (NYSE:BTI). We will take a look at Danaher Corporation (NYSE:DHR), Starbucks Corporation (NASDAQ:SBUX), NextEra Energy, Inc. (NYSE:NEE), and American Express Company (NYSE:AXP). All of these stocks’ market caps resemble BTI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DHR | 58 | 3081018 | 10 |

| SBUX | 47 | 4588018 | 5 |

| NEE | 36 | 857567 | -1 |

| AXP | 57 | 19790830 | 7 |

| Average | 49.5 | 7079358 | 5.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 49.5 hedge funds with bullish positions and the average amount invested in these stocks was $7079 million. That figure was $316 million in BTI’s case. Danaher Corporation (NYSE:DHR) is the most popular stock in this table. On the other hand NextEra Energy, Inc. (NYSE:NEE) is the least popular one with only 36 bullish hedge fund positions. Compared to these stocks British American Tobacco plc (NYSE:BTI) is even less popular than NEE. Hedge funds dodged a bullet by taking a bearish stance towards BTI. Our calculations showed that the top 20 most popular hedge fund stocks returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately BTI wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); BTI investors were disappointed as the stock returned -15% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.