Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed over the past few years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that hedge funds do have great stock picking skills, so let’s take a glance at the smart money sentiment towards Boyd Gaming Corporation (NYSE:BYD).

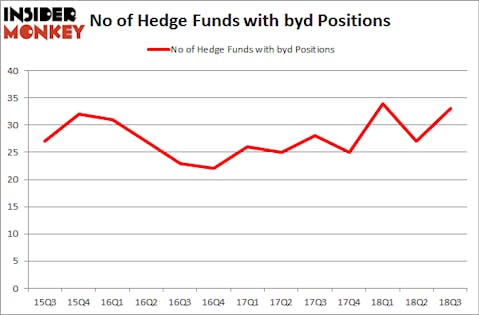

Is Boyd Gaming Corporation (NYSE:BYD) a buy here? Money managers are buying. The number of long hedge fund bets increased by 6 recently. Our calculations also showed that byd isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are tons of methods stock market investors have at their disposal to size up publicly traded companies. A duo of the less known methods are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the best hedge fund managers can beat the market by a significant amount (see the details here).

Mario Gabelli of GAMCO Investors

We’re going to go over the new hedge fund action encompassing Boyd Gaming Corporation (NYSE:BYD).

How are hedge funds trading Boyd Gaming Corporation (NYSE:BYD)?

At Q3’s end, a total of 33 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 22% from the previous quarter. By comparison, 25 hedge funds held shares or bullish call options in BYD heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, PAR Capital Management held the most valuable stake in Boyd Gaming Corporation (NYSE:BYD), which was worth $217.6 million at the end of the third quarter. On the second spot was Highline Capital Management which amassed $86.7 million worth of shares. Moreover, Valinor Management LLC, GAMCO Investors, and Appaloosa Management LP were also bullish on Boyd Gaming Corporation (NYSE:BYD), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key money managers were breaking ground themselves. Two Sigma Advisors, managed by John Overdeck and David Siegel, created the biggest position in Boyd Gaming Corporation (NYSE:BYD). Two Sigma Advisors had $10.4 million invested in the company at the end of the quarter. Bruce Kovner’s Caxton Associates LP also made a $3.4 million investment in the stock during the quarter. The other funds with new positions in the stock are David Costen Haley’s HBK Investments, Mike Vranos’s Ellington, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s now review hedge fund activity in other stocks similar to Boyd Gaming Corporation (NYSE:BYD). These stocks are Lumentum Holdings Inc (NASDAQ:LITE), AMC Networks Inc (NASDAQ:AMCX), Louisiana-Pacific Corporation (NYSE:LPX), and Tetra Tech, Inc. (NASDAQ:TTEK). This group of stocks’ market values resemble BYD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LITE | 33 | 197140 | -3 |

| AMCX | 21 | 314255 | 2 |

| LPX | 28 | 360656 | -2 |

| TTEK | 17 | 69201 | 6 |

| Average | 24.75 | 235313 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.75 hedge funds with bullish positions and the average amount invested in these stocks was $235 million. That figure was $759 million in BYD’s case. Lumentum Holdings Inc (NASDAQ:LITE) is the most popular stock in this table. On the other hand Tetra Tech, Inc. (NASDAQ:TTEK) is the least popular one with only 17 bullish hedge fund positions. Boyd Gaming Corporation (NYSE:BYD) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard LITE might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.