“Value has performed relatively poorly since the 2017 shift, but we believe challenges to the S&P 500’s dominance are mounting and resulting active opportunities away from the index are growing. At some point, this fault line will break, likely on the back of rising rates, and all investors will be reminded that the best time to diversify away from the winners is when it is most painful. The bargain of capturing long-term value may be short-term pain, but enough is eventually enough and it comes time to harvest the benefits.,” said Clearbridge Investments in its market commentary. We aren’t sure whether long-term interest rates will top 5% and value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. That’s why we believe it would be worthwhile to take a look at the hedge fund sentiment on Booking Holdings Inc. (NASDAQ:BKNG) in order to identify whether reputable and successful top money managers continue to believe in its potential.

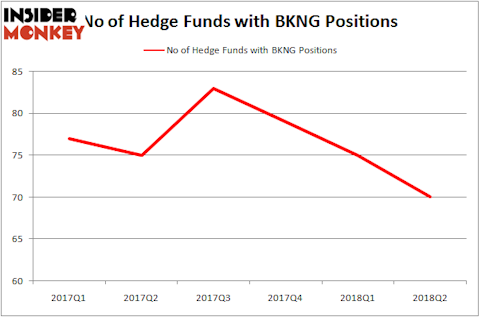

Is Booking Holdings Inc. (NASDAQ:BKNG) a first-rate investment now? The smart money is getting less optimistic. The number of bullish hedge fund positions shrunk by 5 lately. BKNG was in 70 hedge funds’ portfolios at the end of June. There were 75 hedge funds in our database with BKNG positions at the end of the previous quarter. Nevertheless Booking Holdings Inc. was still the 24th most popular stock among hedge funds at the end of the second quarter (see the list of 25 most popular stocks among hedge funds).

In the eyes of most stock holders, hedge funds are viewed as unimportant, old financial tools of the past. While there are over 8000 funds with their doors open at the moment, We hone in on the elite of this group, about 700 funds. It is estimated that this group of investors manage bulk of the hedge fund industry’s total asset base, and by paying attention to their top picks, Insider Monkey has brought to light numerous investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship best performing hedge funds strategy outperformed the market by 40 percentage points since its inception. It also returned 17.4% year to date and surpassed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here).

We’re going to take a look at the fresh hedge fund action surrounding Booking Holdings Inc. (NASDAQ:BKNG).

What does the smart money think about Booking Holdings Inc. (NASDAQ:BKNG)?

At Q3’s end, a total of 70 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -7% from the previous quarter. The graph below displays the number of hedge funds with bullish position in BKNG over the last 6 quarters. With the smart money’s capital changing hands, there exists a few key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

Among these funds, Tiger Global Management LLC held the most valuable stake in Booking Holdings Inc. (NASDAQ:BKNG), which was worth $1332 millions at the end of the second quarter. On the second spot was Lone Pine Capital which amassed $1076.5 millions worth of shares. Moreover, AltaRock Partners, Altimeter Capital Management, and ThornTree Capital Partners were also bullish on Booking Holdings Inc. (NASDAQ:BKNG), allocating a large percentage of their portfolios to this stock.

Because Booking Holdings Inc. (NASDAQ:BKNG) has witnessed bearish sentiment from hedge fund managers, it’s easy to see that there is a sect of funds that elected to cut their full holdings in the second quarter. Intriguingly, Jim Simons’s Renaissance Technologies dumped the biggest stake of the “upper crust” of funds tracked by Insider Monkey, totaling close to $518.8 million in call options., and Steve Cohen’s Point72 Asset Management was right behind this move, as the fund dumped about $104 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest was cut by 5 funds in the second quarter.

Let’s check out hedge fund activity in other stocks similar to Booking Holdings Inc. (NASDAQ:BKNG). We will take a look at Rio Tinto plc (ADR) (NYSE:RIO), Schlumberger Limited. (NYSE:SLB), Eli Lilly & Co. (NYSE:LLY), and Gilead Sciences, Inc. (NASDAQ:GILD). This group of stocks’ market values resemble BKNG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RIO | 20 | 793930 | 2 |

| SLB | 43 | 1599488 | -9 |

| LLY | 33 | 1377697 | -2 |

| GILD | 57 | 3065919 | -7 |

As you can see these stocks had an average of 38.25 hedge funds with bullish positions and the average amount invested in these stocks was $1709 million. That figure was $6679 million in BKNG’s case. Gilead Sciences, Inc. (NASDAQ:GILD) is the most popular stock in this table. On the other hand Rio Tinto plc (ADR) (NYSE:RIO) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Booking Holdings Inc. (NASDAQ:BKNG) is more popular among hedge funds. However, the hedge fund sentiment for BKNG has been declining for the past year and there are better alternatives like Alphabet which is among the top 5 most popular stocks for several years. BKNG also spent more than $1 billion Google ads last quarter. We believe GOOGL is a better buy than Booking Holdings.

Disclosure: None. This article was originally published at Insider Monkey.