Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Bloomin’ Brands Inc (NASDAQ:BLMN).

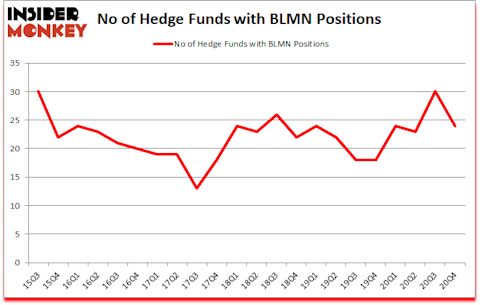

Is BLMN stock a buy? Money managers were getting less bullish. The number of long hedge fund bets were cut by 6 lately. Bloomin’ Brands Inc (NASDAQ:BLMN) was in 24 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 30. Our calculations also showed that BLMN isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 124 percentage points since March 2017 (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the CBD market is growing at a 33% annualized rate, so we are taking a closer look at this under-the-radar hemp stock. We go through lists like the 10 best biotech stocks under $10 to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now let’s take a gander at the fresh hedge fund action surrounding Bloomin’ Brands Inc (NASDAQ:BLMN).

Do Hedge Funds Think BLMN Is A Good Stock To Buy Now?

At the end of December, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -20% from one quarter earlier. By comparison, 18 hedge funds held shares or bullish call options in BLMN a year ago. With hedge funds’ capital changing hands, there exists a few notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Among these funds, JANA Partners held the most valuable stake in Bloomin’ Brands Inc (NASDAQ:BLMN), which was worth $77.7 million at the end of the fourth quarter. On the second spot was Scopus Asset Management which amassed $54.9 million worth of shares. Arrowstreet Capital, Citadel Investment Group, and GLG Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position JANA Partners allocated the biggest weight to Bloomin’ Brands Inc (NASDAQ:BLMN), around 5.26% of its 13F portfolio. DG Capital Management is also relatively very bullish on the stock, designating 5.05 percent of its 13F equity portfolio to BLMN.

Due to the fact that Bloomin’ Brands Inc (NASDAQ:BLMN) has witnessed falling interest from the aggregate hedge fund industry, logic holds that there exists a select few hedge funds that slashed their positions entirely in the fourth quarter. Intriguingly, Robert Pohly’s Samlyn Capital said goodbye to the largest investment of all the hedgies tracked by Insider Monkey, totaling an estimated $12.9 million in stock. Andrew Kurita’s fund, Kettle Hill Capital Management, also dumped its stock, about $5.6 million worth. These moves are interesting, as aggregate hedge fund interest was cut by 6 funds in the fourth quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Bloomin’ Brands Inc (NASDAQ:BLMN) but similarly valued. We will take a look at Monmouth Real Estate Investment Corp. (NYSE:MNR), Heartland Financial USA Inc (NASDAQ:HTLF), Gol Linhas Aereas Inteligentes SA (NYSE:GOL), Hailiang Education Group Inc. (NASDAQ:HLG), Regenxbio Inc (NASDAQ:RGNX), Itau CorpBanca (NYSE:ITCB), and 1-800-FLOWERS.COM, Inc. (NASDAQ:FLWS). This group of stocks’ market values resemble BLMN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MNR | 12 | 68721 | -4 |

| HTLF | 10 | 21251 | 3 |

| GOL | 12 | 48133 | 2 |

| HLG | 1 | 7922 | 0 |

| RGNX | 21 | 214234 | -1 |

| ITCB | 1 | 1546 | 0 |

| FLWS | 27 | 117480 | 4 |

| Average | 12 | 68470 | 0.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $68 million. That figure was $379 million in BLMN’s case. 1-800-FLOWERS.COM, Inc. (NASDAQ:FLWS) is the most popular stock in this table. On the other hand Hailiang Education Group Inc. (NASDAQ:HLG) is the least popular one with only 1 bullish hedge fund positions. Bloomin’ Brands Inc (NASDAQ:BLMN) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for BLMN is 67.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 12.3% in 2021 through April 19th and still beat the market by 0.9 percentage points. Hedge funds were also right about betting on BLMN as the stock returned 46.9% since the end of Q4 (through 4/19) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Bloomin' Brands Inc. (NASDAQ:BLMN)

Follow Bloomin' Brands Inc. (NASDAQ:BLMN)

Receive real-time insider trading and news alerts

Suggested Articles:

- Top 30 Video Games of All Time

- 21 Best Quality of Life Countries in 2021

- 25 Worst Major Cities for Allergies in 2020

Disclosure: None. This article was originally published at Insider Monkey.