Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space.

BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ) shareholders have witnessed an increase in hedge fund sentiment of late. BJ was in 22 hedge funds’ portfolios at the end of March. There were 16 hedge funds in our database with BJ positions at the end of the previous quarter. Our calculations also showed that bj isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are tons of indicators stock market investors have at their disposal to value publicly traded companies. A couple of the less known indicators are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the top investment managers can outpace the S&P 500 by a solid amount (see the details here).

We’re going to take a peek at the new hedge fund action surrounding BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ).

Hedge fund activity in BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ)

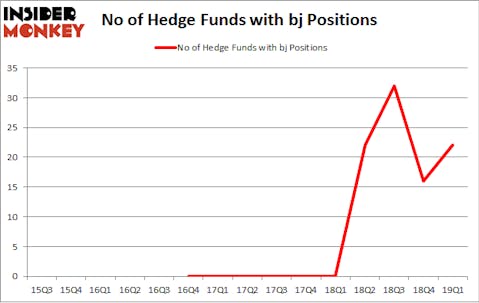

Heading into the second quarter of 2019, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 38% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in BJ over the last 15 quarters. With hedge funds’ sentiment swirling, there exists a select group of notable hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, John Brennan’s Sirios Capital Management has the most valuable position in BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ), worth close to $100.7 million, comprising 6.1% of its total 13F portfolio. The second most bullish fund manager is Marshall Wace LLP, managed by Paul Marshall and Ian Wace, which holds a $27.8 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Some other professional money managers that hold long positions contain Jeffrey Jacobowitz’s Simcoe Capital Management, Anand Parekh’s Alyeska Investment Group and Jeffrey Talpins’s Element Capital Management.

As industrywide interest jumped, key hedge funds have jumped into BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ) headfirst. Element Capital Management, managed by Jeffrey Talpins, initiated the most outsized position in BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ). Element Capital Management had $20.3 million invested in the company at the end of the quarter. John Overdeck and David Siegel’s Two Sigma Advisors also initiated a $8.7 million position during the quarter. The other funds with new positions in the stock are Ward Davis and Brian Agnew’s Caerus Global Investors, Joseph Samuels’s Islet Management, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s also examine hedge fund activity in other stocks similar to BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ). We will take a look at Vermilion Energy Inc (NYSE:VET), PNM Resources, Inc. (NYSE:PNM), FirstCash, Inc. (NASDAQ:FCFS), and Univar Inc (NYSE:UNVR). All of these stocks’ market caps match BJ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VET | 6 | 18169 | -1 |

| PNM | 14 | 323111 | -4 |

| FCFS | 12 | 164726 | 0 |

| UNVR | 42 | 1098378 | 19 |

| Average | 18.5 | 401096 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.5 hedge funds with bullish positions and the average amount invested in these stocks was $401 million. That figure was $256 million in BJ’s case. Univar Inc (NYSE:UNVR) is the most popular stock in this table. On the other hand Vermilion Energy Inc (NYSE:VET) is the least popular one with only 6 bullish hedge fund positions. BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately BJ wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on BJ were disappointed as the stock returned -8.1% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.