Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Bilibili Inc. (NASDAQ:BILI).

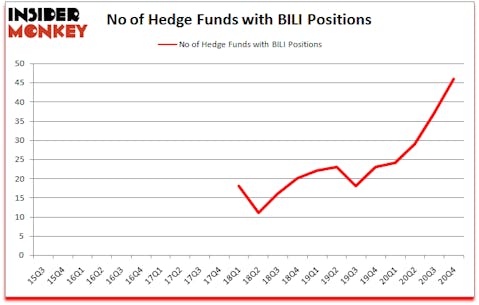

Is BILI stock a buy or sell? Bilibili Inc. (NASDAQ:BILI) was in 46 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 37. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. BILI has seen an increase in hedge fund interest recently. There were 37 hedge funds in our database with BILI holdings at the end of September. Our calculations also showed that BILI isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

Today there are a large number of formulas stock traders use to analyze stocks. A couple of the most innovative formulas are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the best picks of the elite hedge fund managers can beat their index-focused peers by a superb margin (see the details here).

Lei Zhang of Hillhouse Capital Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. Recently Oregon became the first state to legalize psychedelic mushrooms which are shown to have promising results in treating depression, addiction, and PTSD in early stage academic studies. So, we are checking out this psychedelic drug stock idea right now. We go through lists like the 10 best biotech stocks to invest in to pick the next stock that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage (or at the end of this article).Keeping this in mind we’re going to take a look at the latest hedge fund action regarding Bilibili Inc. (NASDAQ:BILI).

Do Hedge Funds Think BILI Is A Good Stock To Buy Now?

Heading into the first quarter of 2021, a total of 46 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 24% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards BILI over the last 22 quarters. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

More specifically, Lone Pine Capital was the largest shareholder of Bilibili Inc. (NASDAQ:BILI), with a stake worth $514.7 million reported as of the end of December. Trailing Lone Pine Capital was Alkeon Capital Management, which amassed a stake valued at $489.5 million. Yiheng Capital, Hillhouse Capital Management, and Boyu Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Boyu Capital allocated the biggest weight to Bilibili Inc. (NASDAQ:BILI), around 49.53% of its 13F portfolio. Yiheng Capital is also relatively very bullish on the stock, dishing out 22.25 percent of its 13F equity portfolio to BILI.

As one would reasonably expect, key money managers have been driving this bullishness. Lone Pine Capital, established the most outsized position in Bilibili Inc. (NASDAQ:BILI). Lone Pine Capital had $514.7 million invested in the company at the end of the quarter. Xiaomeng Tong’s Boyu Capital also initiated a $269.5 million position during the quarter. The other funds with brand new BILI positions are Alex Sacerdote’s Whale Rock Capital Management, Andreas Halvorsen’s Viking Global, and Simon Sadler’s Segantii Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Bilibili Inc. (NASDAQ:BILI) but similarly valued. We will take a look at Eversource Energy (NYSE:ES), Public Service Enterprise Group Incorporated (NYSE:PEG), Otis Worldwide Corporation (NYSE:OTIS), Rockwell Automation Inc. (NYSE:ROK), EOG Resources Inc (NYSE:EOG), Banco Bradesco SA (NYSE:BBD), and WEC Energy Group, Inc. (NYSE:WEC). This group of stocks’ market values match BILI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ES | 24 | 511581 | 4 |

| PEG | 28 | 374371 | 5 |

| OTIS | 59 | 2512029 | 6 |

| ROK | 35 | 635317 | -9 |

| EOG | 45 | 750152 | 9 |

| BBD | 17 | 407632 | -3 |

| WEC | 25 | 245402 | 3 |

| Average | 33.3 | 776641 | 2.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.3 hedge funds with bullish positions and the average amount invested in these stocks was $777 million. That figure was $3084 million in BILI’s case. Otis Worldwide Corporation (NYSE:OTIS) is the most popular stock in this table. On the other hand Banco Bradesco SA (NYSE:BBD) is the least popular one with only 17 bullish hedge fund positions. Bilibili Inc. (NASDAQ:BILI) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for BILI is 74.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 5.3% in 2021 through March 19th and still beat the market by 0.8 percentage points. Hedge funds were also right about betting on BILI as the stock returned 27% since the end of Q4 (through 3/19) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Bilibili Inc. (NASDAQ:BILI)

Follow Bilibili Inc. (NASDAQ:BILI)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.