Last year’s fourth quarter was a rough one for investors and many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. Luckily hedge funds were shifting their holdings into large-cap stocks. The 20 most popular hedge fund stocks actually generated an average return of 37.4% in 2019 (through the end of November) and outperformed the S&P 500 ETF by 9.9 percentage points. We are done processing the latest 13F filings and in this article we will study how hedge fund sentiment towards Benchmark Electronics, Inc. (NYSE:BHE) changed during the first quarter.

Is Benchmark Electronics, Inc. (NYSE:BHE) worth your attention right now? Investors who are in the know are getting more bullish. The number of long hedge fund bets rose by 1 lately. Our calculations also showed that BHE isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Paul Marshall of Marshall Wace

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to go over the fresh hedge fund action surrounding Benchmark Electronics, Inc. (NYSE:BHE).

How are hedge funds trading Benchmark Electronics, Inc. (NYSE:BHE)?

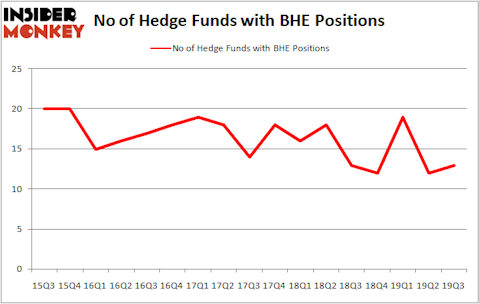

Heading into the fourth quarter of 2019, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the second quarter of 2019. On the other hand, there were a total of 13 hedge funds with a bullish position in BHE a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Benchmark Electronics, Inc. (NYSE:BHE) was held by Renaissance Technologies, which reported holding $16.1 million worth of stock at the end of September. It was followed by D E Shaw with a $12 million position. Other investors bullish on the company included Two Sigma Advisors, Citadel Investment Group, and AQR Capital Management. In terms of the portfolio weights assigned to each position Ellington allocated the biggest weight to Benchmark Electronics, Inc. (NYSE:BHE), around 0.08% of its 13F portfolio. Paloma Partners is also relatively very bullish on the stock, designating 0.02 percent of its 13F equity portfolio to BHE.

As industrywide interest jumped, key hedge funds have jumped into Benchmark Electronics, Inc. (NYSE:BHE) headfirst. Point72 Asset Management, managed by Steve Cohen, initiated the most valuable position in Benchmark Electronics, Inc. (NYSE:BHE). Point72 Asset Management had $1.1 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace also made a $1.1 million investment in the stock during the quarter. The only other fund with a brand new BHE position is Benjamin A. Smith’s Laurion Capital Management.

Let’s now review hedge fund activity in other stocks similar to Benchmark Electronics, Inc. (NYSE:BHE). These stocks are SM Energy Company (NYSE:SM), Middlesex Water Company (NASDAQ:MSEX), Standard Motor Products, Inc. (NYSE:SMP), and Natus Medical Incorporated (NASDAQ:NTUS). All of these stocks’ market caps match BHE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SM | 20 | 103726 | 2 |

| MSEX | 10 | 54131 | 1 |

| SMP | 13 | 111656 | 2 |

| NTUS | 21 | 82632 | -1 |

| Average | 16 | 88036 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $88 million. That figure was $45 million in BHE’s case. Natus Medical Incorporated (NASDAQ:NTUS) is the most popular stock in this table. On the other hand Middlesex Water Company (NASDAQ:MSEX) is the least popular one with only 10 bullish hedge fund positions. Benchmark Electronics, Inc. (NYSE:BHE) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on BHE as the stock returned 18.6% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.