As we already know from media reports and hedge fund investor letters, many hedge funds lost money in October, blaming macroeconomic conditions and unpredictable events that hit several sectors, with healthcare among them. Nevertheless, most investors decided to stick to their bullish theses and their long-term focus allows us to profit from the recent declines. In particular, let’s take a look at what hedge funds think about Autoliv Inc. (NYSE:ALV) in this article.

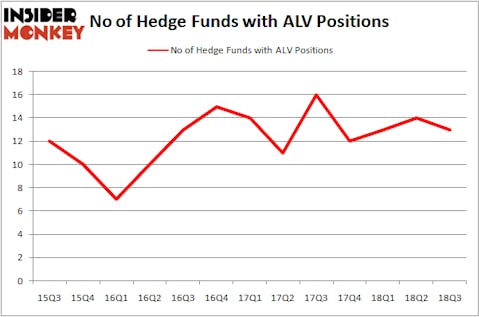

Autoliv Inc. (NYSE:ALV) has seen a decrease in enthusiasm from smart money of late. Our calculations also showed that ALV isn’t among the 30 most popular stocks among hedge funds.

According to most traders, hedge funds are assumed to be worthless, outdated investment tools of the past. While there are greater than 8,000 funds in operation at present, Our researchers hone in on the aristocrats of this group, about 700 funds. These hedge fund managers preside over the majority of all hedge funds’ total capital, and by tracking their top stock picks, Insider Monkey has found a few investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s view the latest hedge fund action encompassing Autoliv Inc. (NYSE:ALV).

What does the smart money think about Autoliv Inc. (NYSE:ALV)?

At the end of the third quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -7% from one quarter earlier. On the other hand, there were a total of 12 hedge funds with a bullish position in ALV at the beginning of this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

The largest stake in Autoliv Inc. (NYSE:ALV) was held by Cevian Capital, which reported holding $496.1 million worth of stock at the end of September. It was followed by OZ Management with a $20.6 million position. Other investors bullish on the company included Renaissance Technologies, Ulysses Management, and Beddow Capital Management.

Because Autoliv Inc. (NYSE:ALV) has faced bearish sentiment from the smart money, it’s easy to see that there exists a select few hedgies who sold off their full holdings by the end of the third quarter. It’s worth mentioning that Kenneth Squire’s 13D Management said goodbye to the biggest stake of all the hedgies tracked by Insider Monkey, valued at close to $12.5 million in stock, and Benjamin A. Smith’s Laurion Capital Management was right behind this move, as the fund sold off about $7.1 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest dropped by 1 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks similar to Autoliv Inc. (NYSE:ALV). We will take a look at Carlyle Group LP (NASDAQ:CG), Harley-Davidson, Inc. (NYSE:HOG), World Wrestling Entertainment, Inc. (NYSE:WWE), and Alcoa Corporation (NYSE:AA). This group of stocks’ market caps are closest to ALV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CG | 10 | 123719 | 0 |

| HOG | 20 | 154494 | 3 |

| WWE | 24 | 782472 | 0 |

| AA | 38 | 1082615 | 6 |

| Average | 23 | 535825 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $536 million. That figure was $556 million in ALV’s case. Alcoa Corporation (NYSE:AA) is the most popular stock in this table. On the other hand Carlyle Group LP (NASDAQ:CG) is the least popular one with only 10 bullish hedge fund positions. Autoliv Inc. (NYSE:ALV) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard AA might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.