At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Autodesk, Inc. (NASDAQ:ADSK).

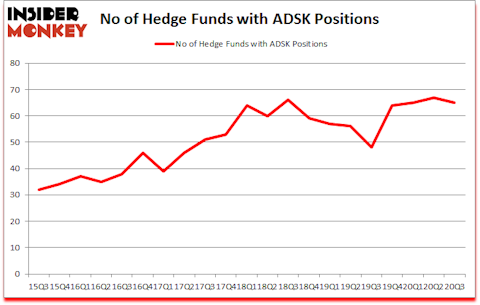

Is Autodesk, Inc. (NASDAQ:ADSK) a good stock to buy now? The best stock pickers were in a bearish mood. The number of bullish hedge fund bets went down by 2 in recent months. Autodesk, Inc. (NASDAQ:ADSK) was in 65 hedge funds’ portfolios at the end of the third quarter of 2020. The all time high for this statistics is 67. Our calculations also showed that ADSK isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are several gauges market participants put to use to value publicly traded companies. A pair of the most under-the-radar gauges are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the elite investment managers can outperform their index-focused peers by a healthy amount (see the details here).

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets. Tesla’s stock price skyrocketed, yet lithium prices are still below their 2019 highs. So, we are checking out this lithium stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Keeping this in mind we’re going to take a look at the latest hedge fund action encompassing Autodesk, Inc. (NASDAQ:ADSK).

What have hedge funds been doing with Autodesk, Inc. (NASDAQ:ADSK)?

Heading into the fourth quarter of 2020, a total of 65 of the hedge funds tracked by Insider Monkey were long this stock, a change of -3% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ADSK over the last 21 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Lone Pine Capital, holds the number one position in Autodesk, Inc. (NASDAQ:ADSK). Lone Pine Capital has a $676.3 million position in the stock, comprising 2.9% of its 13F portfolio. On Lone Pine Capital’s heels is Cantillon Capital Management, led by William von Mueffling, holding a $296.9 million position; 2.5% of its 13F portfolio is allocated to the stock. Remaining peers that are bullish contain D. E. Shaw’s D E Shaw, John Overdeck and David Siegel’s Two Sigma Advisors and Ian Simm’s Impax Asset Management. In terms of the portfolio weights assigned to each position Marlowe Partners allocated the biggest weight to Autodesk, Inc. (NASDAQ:ADSK), around 15.21% of its 13F portfolio. Blue Whale Capital is also relatively very bullish on the stock, setting aside 7.94 percent of its 13F equity portfolio to ADSK.

Since Autodesk, Inc. (NASDAQ:ADSK) has faced a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there exists a select few funds that decided to sell off their full holdings by the end of the third quarter. It’s worth mentioning that Zach Schreiber’s Point State Capital cut the largest investment of all the hedgies watched by Insider Monkey, valued at an estimated $5.7 million in stock. Richard SchimeláandáLawrence Sapanski’s fund, Cinctive Capital Management, also sold off its stock, about $3.2 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest dropped by 2 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Autodesk, Inc. (NASDAQ:ADSK) but similarly valued. These stocks are Dell Technologies Inc. (NYSE:DELL), Kimberly Clark Corporation (NYSE:KMB), The Bank of Nova Scotia (NYSE:BNS), Barrick Gold Corporation (NYSE:GOLD), Brookfield Asset Management Inc. (NYSE:BAM), Edwards Lifesciences Corporation (NYSE:EW), and China Petroleum & Chemical Corp (NYSE:SNP). This group of stocks’ market caps are similar to ADSK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DELL | 43 | 3763509 | -7 |

| KMB | 41 | 1510301 | 4 |

| BNS | 14 | 175517 | 1 |

| GOLD | 52 | 3095841 | 0 |

| BAM | 35 | 1080514 | 2 |

| EW | 46 | 1122952 | 1 |

| SNP | 8 | 168584 | -2 |

| Average | 34.1 | 1559603 | -0.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.1 hedge funds with bullish positions and the average amount invested in these stocks was $1560 million. That figure was $3170 million in ADSK’s case. Barrick Gold Corporation (NYSE:GOLD) is the most popular stock in this table. On the other hand China Petroleum & Chemical Corp (NYSE:SNP) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Autodesk, Inc. (NASDAQ:ADSK) is more popular among hedge funds. Our overall hedge fund sentiment score for ADSK is 82.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks returned 30.7% in 2020 through November 27th but still managed to beat the market by 16.1 percentage points. Hedge funds were also right about betting on ADSK as the stock returned 18.1% since the end of September (through 11/27) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Autodesk Inc. (NASDAQ:ADSK)

Follow Autodesk Inc. (NASDAQ:ADSK)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.