The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Attunity Ltd (NASDAQ:ATTU).

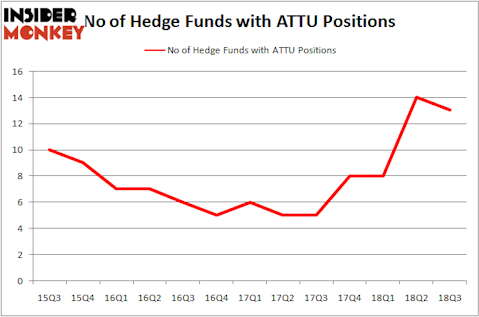

Is Attunity Ltd (NASDAQ:ATTU) a bargain? The smart money is becoming less hopeful. The number of bullish hedge fund bets were cut by 1 recently. Our calculations also showed that ATTU isn’t among the 30 most popular stocks among hedge funds. ATTU was in 13 hedge funds’ portfolios at the end of the third quarter of 2018. There were 14 hedge funds in our database with ATTU positions at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s take a peek at the latest hedge fund action encompassing Attunity Ltd (NASDAQ:ATTU).

How are hedge funds trading Attunity Ltd (NASDAQ:ATTU)?

At the end of the third quarter, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of -7% from the previous quarter. The graph below displays the number of hedge funds with bullish position in ATTU over the last 13 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

The largest stake in Attunity Ltd (NASDAQ:ATTU) was held by G2 Investment Partners Management, which reported holding $18.2 million worth of stock at the end of September. It was followed by Portolan Capital Management with a $14.3 million position. Other investors bullish on the company included Whetstone Capital Advisors, Royce & Associates, and Rima Senvest Management.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Gratia Capital. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 700+ hedge funds tracked by Insider Monkey identified ATTU as a viable investment and initiated a position in the stock.

Let’s go over hedge fund activity in other stocks similar to Attunity Ltd (NASDAQ:ATTU). These stocks are Drive Shack Inc. (NYSE:DS), Wells Fargo Advantage Multi-Sector Income Fund (NYSE:ERC), Enterprise Bancorp, Inc (NASDAQ:EBTC), and Hooker Furniture Corporation (NASDAQ:HOFT). This group of stocks’ market values are closest to ATTU’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DS | 7 | 16140 | -1 |

| ERC | 2 | 1314 | -1 |

| EBTC | 2 | 2843 | 0 |

| HOFT | 8 | 82439 | -2 |

| Average | 4.75 | 25684 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4.75 hedge funds with bullish positions and the average amount invested in these stocks was $26 million. That figure was $89 million in ATTU’s case. Hooker Furniture Corporation (NASDAQ:HOFT) is the most popular stock in this table. On the other hand Wells Fargo Multi-Sector Income Fund (NYSE:ERC) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Attunity Ltd (NASDAQ:ATTU) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.