The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their September 30 holdings, data that is available nowhere else. Should you consider Atlassian Corporation PLC(NASDAQ:TEAM) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

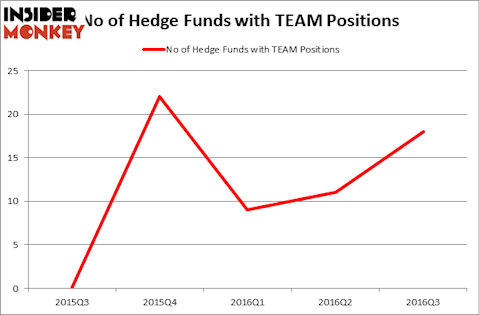

Is Atlassian Corporation PLC(NASDAQ:TEAM) a buy here? It looks like hedge funds are getting more bullish. During the third quarter, the number of funds from our database long the stock went up by seven to 18. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Gildan Activewear Inc (USA) (NYSE:GIL), American Capital Agency Corp. (NASDAQ:AGNC), and FMC Corp (NYSE:FMC) to gather more data points.

Follow Techteam Global Inc (NASDAQ:TEAM)

Follow Techteam Global Inc (NASDAQ:TEAM)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Fer Gregory/Shutterstock.com

Now, we’re going to take a gander at the recent action regarding Atlassian Corporation PLC(NASDAQ:TEAM).

What does the smart money think about Atlassian Corporation PLC(NASDAQ:TEAM)?

Heading into the fourth quarter of 2016, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, up by 64% over the quarter. Below, you can check out the change in hedge fund sentiment towards TEAM over the last five quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Matthew Iorio’s White Elm Capital holds the largest position in Atlassian Corporation PLC(NASDAQ:TEAM) which has a $23.4 million position in the stock, comprising 3% of its 13F portfolio. The second most bullish fund Renaissance Technologies, one of the biggest hedge funds in the world, holding a $20.5 million position. Remaining peers that are bullish consist of Chase Coleman’s Tiger Global Management LLC and Michael Hintze’s CQS Cayman LP. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

With a general bullishness amongst the heavyweights, some big names have jumped into Atlassian Corporation PLC(NASDAQ:TEAM) headfirst. White Elm Capital created the biggest position in Atlassian Corporation PLC(NASDAQ:TEAM). White Elm Capital had $23.4 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $8.8 million position during the quarter. The other funds with new positions in the stock are John Overdeck and David Siegel’s Two Sigma Advisors, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Ken Griffin’s Citadel Investment Group.

Let’s check out hedge fund activity in other stocks similar to Atlassian Corporation PLC (NASDAQ:TEAM). We will take a look at Gildan Activewear Inc (USA) (NYSE:GIL), American Capital Agency Corp. (NASDAQ:AGNC), FMC Corp (NYSE:FMC), and SS and C Technologies Holdings Inc (NASDAQ:SSNC). This group of stocks’ market values are closest to TEAM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GIL | 10 | 84775 | -3 |

| AGNC | 11 | 154784 | -8 |

| FMC | 28 | 1015438 | -9 |

| SSNC | 30 | 1121001 | -1 |

As you can see these stocks had an average of 20 funds with bullish positions and the average amount invested in these stocks was $594 million, which is higher than the $101 million in TEAM’s case. SS and C Technologies Holdings Inc (NASDAQ:SSNC) is the most popular stock in this table with 30 funds holding shares. On the other hand Gildan Activewear Inc (USA) (NYSE:GIL) is the least popular one with only 10 bullish hedge fund positions. Atlassian Corporation PLC (NASDAQ:TEAM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SS and C Technologies Holdings Inc (NASDAQ:SSNC) might be a better candidate to consider taking a long position in.

Disclosure: None