Last year we predicted the arrival of the first US recession since 2009 and we told in advance that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Astronics Corporation (NASDAQ:ATRO).

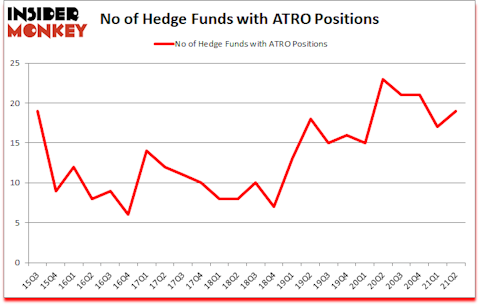

Astronics Corporation (NASDAQ:ATRO) investors should be aware of an increase in activity from the world’s largest hedge funds recently. Astronics Corporation (NASDAQ:ATRO) was in 19 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 23. Our calculations also showed that ATRO isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Hedge funds have more than $3.5 trillion in assets under management, so you can’t expect their entire portfolios to beat the market by large margins. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 79 percentage points since March 2017 (see the details here). So you can still find a lot of gems by following hedge funds’ moves today.

Jeffrey Bronchick of Cove Street Capital

With all of this in mind we’re going to take a look at the key hedge fund action surrounding Astronics Corporation (NASDAQ:ATRO).

Do Hedge Funds Think ATRO Is A Good Stock To Buy Now?

At the end of the second quarter, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 12% from one quarter earlier. On the other hand, there were a total of 23 hedge funds with a bullish position in ATRO a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Astronics Corporation (NASDAQ:ATRO) was held by Paradice Investment Management, which reported holding $21.4 million worth of stock at the end of June. It was followed by Royce & Associates with a $20.9 million position. Other investors bullish on the company included Cove Street Capital, Bares Capital Management, and Minerva Advisors. In terms of the portfolio weights assigned to each position Minerva Advisors allocated the biggest weight to Astronics Corporation (NASDAQ:ATRO), around 3.12% of its 13F portfolio. Roubaix Capital is also relatively very bullish on the stock, setting aside 1.95 percent of its 13F equity portfolio to ATRO.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls’ herd. Cove Street Capital, managed by Jeffrey Bronchick, assembled the most valuable position in Astronics Corporation (NASDAQ:ATRO). Cove Street Capital had $11.5 million invested in the company at the end of the quarter. Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors also initiated a $0.9 million position during the quarter. The other funds with new positions in the stock are Peter Muller’s PDT Partners, Matthew Hulsizer’s PEAK6 Capital Management, and Matthew L Pinz’s Pinz Capital.

Let’s now review hedge fund activity in other stocks similar to Astronics Corporation (NASDAQ:ATRO). We will take a look at Zynex, Inc. (NASDAQ:ZYXI), Berry Corporation (NASDAQ:BRY), Calumet Specialty Products Partners, L.P (NASDAQ:CLMT), REX American Resources Corp (NYSE:REX), TrueCar Inc (NASDAQ:TRUE), American Vanguard Corp. (NYSE:AVD), and Akoustis Technologies, Inc. (NASDAQ:AKTS). This group of stocks’ market values resemble ATRO’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZYXI | 7 | 2845 | 1 |

| BRY | 16 | 100474 | 3 |

| CLMT | 3 | 24986 | -1 |

| REX | 8 | 43950 | -3 |

| TRUE | 17 | 96938 | 1 |

| AVD | 9 | 19943 | 2 |

| AKTS | 5 | 14602 | -3 |

| Average | 9.3 | 43391 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.3 hedge funds with bullish positions and the average amount invested in these stocks was $43 million. That figure was $95 million in ATRO’s case. TrueCar Inc (NASDAQ:TRUE) is the most popular stock in this table. On the other hand Calumet Specialty Products Partners, L.P (NASDAQ:CLMT) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Astronics Corporation (NASDAQ:ATRO) is more popular among hedge funds. Our overall hedge fund sentiment score for ATRO is 81.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. Unfortunately ATRO wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on ATRO were disappointed as the stock returned -24.2% since the end of the second quarter (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Astronics Corp (NASDAQ:ATRO)

Follow Astronics Corp (NASDAQ:ATRO)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Augmented Reality Stocks to Buy Now

- 10 Biggest Cryptocurrency Predictions in 2021

- Ray Dalio’s Top 10 Stock Picks for 2021

Disclosure: None. This article was originally published at Insider Monkey.