It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. Luckily hedge funds were shifting their holdings into large-cap stocks. The 20 most popular hedge fund stocks actually generated an average return of 18.7% so far in 2019 and outperformed the S&P 500 ETF by 6.6 percentage points. We are done processing the latest 13f filings and in this article we will study how hedge fund sentiment towards Arrow Electronics, Inc. (NYSE:ARW) changed during the first quarter.

Arrow Electronics, Inc. (NYSE:ARW) has experienced an increase in hedge fund sentiment lately. Our calculations also showed that ARW isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a lot of formulas stock traders put to use to assess stocks. A couple of the most innovative formulas are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the best picks of the top fund managers can beat the market by a solid margin (see the details here).

We’re going to check out the recent hedge fund action surrounding Arrow Electronics, Inc. (NYSE:ARW).

How are hedge funds trading Arrow Electronics, Inc. (NYSE:ARW)?

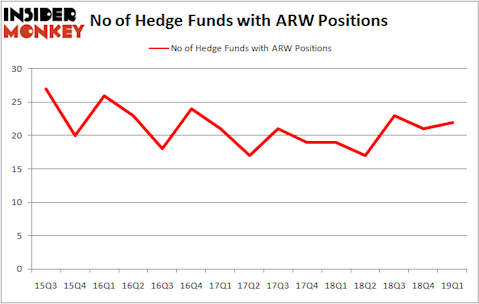

At the end of the first quarter, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards ARW over the last 15 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Citadel Investment Group, managed by Ken Griffin, holds the largest position in Arrow Electronics, Inc. (NYSE:ARW). Citadel Investment Group has a $133 million position in the stock, comprising 0.1% of its 13F portfolio. The second largest stake is held by AQR Capital Management, led by Cliff Asness, holding a $129.7 million position; 0.1% of its 13F portfolio is allocated to the stock. Remaining members of the smart money that are bullish comprise Thomas E. Claugus’s GMT Capital, Phill Gross and Robert Atchinson’s Adage Capital Management and Richard S. Pzena’s Pzena Investment Management.

Consequently, key money managers have been driving this bullishness. Millennium Management, managed by Israel Englander, assembled the biggest position in Arrow Electronics, Inc. (NYSE:ARW). Millennium Management had $19.3 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $13.1 million investment in the stock during the quarter. The other funds with new positions in the stock are Jim Simons’s Renaissance Technologies and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Arrow Electronics, Inc. (NYSE:ARW) but similarly valued. These stocks are Perrigo Company plc (NYSE:PRGO), American Campus Communities, Inc. (NYSE:ACC), Logitech International SA (NASDAQ:LOGI), and Aqua America Inc (NYSE:WTR). This group of stocks’ market caps are closest to ARW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PRGO | 18 | 662267 | -5 |

| ACC | 19 | 322439 | 3 |

| LOGI | 15 | 239756 | 1 |

| WTR | 15 | 138874 | -4 |

| Average | 16.75 | 340834 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $341 million. That figure was $473 million in ARW’s case. American Campus Communities, Inc. (NYSE:ACC) is the most popular stock in this table. On the other hand Logitech International SA (NASDAQ:LOGI) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Arrow Electronics, Inc. (NYSE:ARW) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately ARW wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ARW were disappointed as the stock returned -16.2% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.