The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of June 30th. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Ares Commercial Real Estate Corp (NYSE:ACRE).

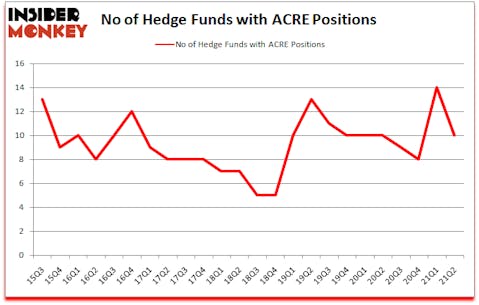

Is Ares Commercial Real Estate Corp (NYSE:ACRE) going to take off soon? Investors who are in the know were reducing their bets on the stock. The number of long hedge fund positions went down by 4 lately. Ares Commercial Real Estate Corp (NYSE:ACRE) was in 10 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 14. Our calculations also showed that ACRE isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). There were 14 hedge funds in our database with ACRE positions at the end of the first quarter.

If you’d ask most stock holders, hedge funds are perceived as worthless, old investment tools of years past. While there are more than 8000 funds with their doors open at the moment, We hone in on the top tier of this group, around 850 funds. These hedge fund managers orchestrate the lion’s share of the smart money’s total capital, and by shadowing their first-class stock picks, Insider Monkey has figured out various investment strategies that have historically outpaced Mr. Market. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

David Siegel of Two Sigma Advisors

With all of this in mind let’s check out the latest hedge fund action surrounding Ares Commercial Real Estate Corp (NYSE:ACRE).

Do Hedge Funds Think ACRE Is A Good Stock To Buy Now?

At second quarter’s end, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -29% from one quarter earlier. On the other hand, there were a total of 10 hedge funds with a bullish position in ACRE a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Millennium Management was the largest shareholder of Ares Commercial Real Estate Corp (NYSE:ACRE), with a stake worth $12.9 million reported as of the end of June. Trailing Millennium Management was Two Sigma Advisors, which amassed a stake valued at $9.3 million. LDR Capital, Citadel Investment Group, and Citadel Investment Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position LDR Capital allocated the biggest weight to Ares Commercial Real Estate Corp (NYSE:ACRE), around 2.71% of its 13F portfolio. Winton Capital Management is also relatively very bullish on the stock, designating 0.03 percent of its 13F equity portfolio to ACRE.

Due to the fact that Ares Commercial Real Estate Corp (NYSE:ACRE) has faced falling interest from the aggregate hedge fund industry, we can see that there lies a certain “tier” of hedge funds who were dropping their entire stakes in the second quarter. At the top of the heap, Emanuel J. Friedman’s EJF Capital dropped the largest investment of all the hedgies monitored by Insider Monkey, comprising an estimated $7.9 million in stock, Renaissance Technologies was right behind this move, as the fund said goodbye to about $2.5 million worth. These bearish behaviors are important to note, as total hedge fund interest was cut by 4 funds in the second quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Ares Commercial Real Estate Corp (NYSE:ACRE) but similarly valued. We will take a look at Sterling Construction Company, Inc. (NASDAQ:STRL), W&T Offshore, Inc. (NYSE:WTI), Franks International NV (NYSE:FI), Chimerix Inc (NASDAQ:CMRX), Barings BDC, Inc. (NYSE:BBDC), Valhi, Inc. (NYSE:VHI), and Koppers Holdings Inc. (NYSE:KOP). This group of stocks’ market values are closest to ACRE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| STRL | 16 | 60857 | 3 |

| WTI | 18 | 28996 | 5 |

| FI | 8 | 5470 | -1 |

| CMRX | 19 | 152492 | 3 |

| BBDC | 15 | 62510 | 1 |

| VHI | 4 | 6602 | 0 |

| KOP | 9 | 44434 | -2 |

| Average | 12.7 | 51623 | 1.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.7 hedge funds with bullish positions and the average amount invested in these stocks was $52 million. That figure was $32 million in ACRE’s case. Chimerix Inc (NASDAQ:CMRX) is the most popular stock in this table. On the other hand Valhi, Inc. (NYSE:VHI) is the least popular one with only 4 bullish hedge fund positions. Ares Commercial Real Estate Corp (NYSE:ACRE) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for ACRE is 42.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 25.7% in 2021 through September 27th and still beat the market by 6.2 percentage points. A small number of hedge funds were also right about betting on ACRE as the stock returned 6.7% since the end of the second quarter (through 9/27) and outperformed the market by an even larger margin.

Follow Ares Commercial Real Estate Corp (NYSE:ACRE)

Follow Ares Commercial Real Estate Corp (NYSE:ACRE)

Receive real-time insider trading and news alerts

Suggested Articles:

- 20 Most Deadliest and Dangerous Snakes In the World

- Billionaire Daniel Sundheim’s Top 10 Picks

- 15 Very High Yield Dividend Stocks Worth Checking Out

Disclosure: None. This article was originally published at Insider Monkey.