You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

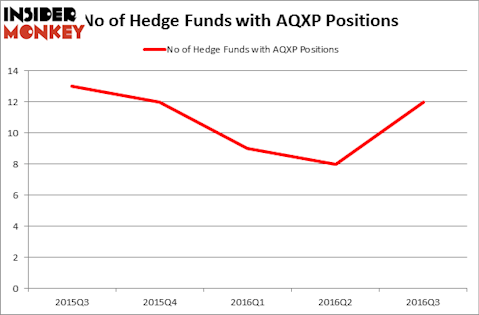

Is Aquinox Pharmaceuticals Inc (NASDAQ:AQXP) the right investment to pursue these days? Investors who are in the know are absolutely getting more optimistic. The number of bullish hedge fund investments increased by 4 in recent months. AQXP was in 12 hedge funds’ portfolios at the end of the third quarter of 2016. There were 8 hedge funds in our database with AQXP holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Luxfer Holdings PLC (ADR) (NYSE:LXFR), FRP Holdings Inc (NASDAQ:FRPH), and Davids Tea Inc (NASDAQ:DTEA) to gather more data points.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

racorn/Shutterstock.com

Now, let’s take a look at the latest action regarding Aquinox Pharmaceuticals Inc (NASDAQ:AQXP).

What does the smart money think about Aquinox Pharmaceuticals Inc (NASDAQ:AQXP)?

Heading into the fourth quarter of 2016, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 50% from one quarter earlier. By comparison, 12 hedge funds held shares or bullish call options in AQXP heading into this year. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Julian Baker and Felix Baker’s Baker Bros. Advisors holds the number one position in Aquinox Pharmaceuticals Inc (NASDAQ:AQXP). Baker Bros. Advisors has a $140.8 million position in the stock, comprising 1.3% of its 13F portfolio. On Baker Bros. Advisors’ heels is Peter Kolchinsky of RA Capital Management, with a $29.3 million position; 3% of its 13F portfolio is allocated to the stock. Other hedge funds and institutional investors that hold long positions encompass Ori Hershkovitz’s Nexthera Capital, James A. Silverman’s Opaleye Management and Anand Parekh’s Alyeska Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As one would reasonably expect, key money managers were leading the bulls’ herd. Ghost Tree Capital, led by Ken Greenberg and David Kim, initiated the biggest position in Aquinox Pharmaceuticals Inc (NASDAQ:AQXP). Ghost Tree Capital had $3.3 million invested in the company at the end of the quarter. Glenn Russell Dubin’s Highbridge Capital Management also initiated a $0.3 million position during the quarter. The following funds were also among the new AQXP investors: Nathan Fischel’s DAFNA Capital Management, Mike Vranos’ Ellington, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Aquinox Pharmaceuticals Inc (NASDAQ:AQXP) but similarly valued. We will take a look at Luxfer Holdings PLC (ADR) (NYSE:LXFR), FRP Holdings Inc (NASDAQ:FRPH), Davids Tea Inc (NASDAQ:DTEA), and Silicom Ltd. (NASDAQ:SILC). This group of stocks’ market caps resemble AQXP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LXFR | 12 | 85904 | 2 |

| FRPH | 6 | 39702 | 1 |

| DTEA | 4 | 4882 | 4 |

| SILC | 4 | 6211 | 4 |

As you can see these stocks had an average of 6 hedge funds with bullish positions and the average amount invested in these stocks was $34 million. That figure was $191 million in AQXP’s case. Luxfer Holdings PLC (ADR) (NYSE:LXFR) is the most popular stock in this table. On the other hand Davids Tea Inc (NASDAQ:DTEA) is the least popular one with only 4 bullish hedge fund positions. Aquinox Pharmaceuticals Inc (NASDAQ:AQXP) is the most popular stock in this group. We believe investors should take a closer look at the stock and consider increasing their exposure.

Disclosure: None