It’s inevitable and undeniable that Apple Inc. (NASDAQ:AAPL) growth is slowing. In fact, a few years from now, sales of iPhones, iPads and other hardware could slow to single digits.

Apple’s amazing growth

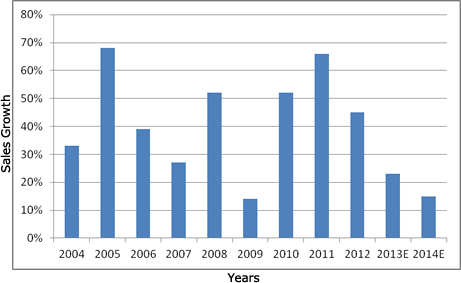

Fiscal year ends September

Consider that Apple Inc. (NASDAQ:AAPL)’s sales have grown at least 20% in eight of the past nine years. This amazing growth should happen again in the current fiscal year that began in October. But after that, Apple’s days of 20%-plus sales growth may be over. That’s what happens when a company’s revenue base starts to approach $200 billion.

Make no mistake, boosting sales from under $10 billion in fiscal (September) 2004 to a projected $192 billion in the current year is the key factor behind Apple Inc. (NASDAQ:AAPL)’s ever-rising stock price. But in the years ahead, it will be another factor that will help propel shares to fresh heights.

That factor: rising recurring revenue per user. We’ve known all along that Apple Inc. (NASDAQ:AAPL)’s main goal was to seed the world with its hardware, so it can eventually sell software and services. The highly popular iTunes music service was just the beginning. The iPad, with its expanding level of apps and video offerings is just another leg. An Apple-based TV, rumored to launch in coming months, is the final leg to the stool.

Once all of these hardware platforms are in place, expect to hear a lot more about how Apple Inc. (NASDAQ:AAPL)intends to become your home entertainment center, virtually replacing the cable TV connection upon which millions of Americans have come to rely. Apple will deliver a competitively-priced suite of video, audio and gaming services likely to rival what the average consumer now pays for a monthly, premium cable TV package (assuming they “cut the cord” from cable TV, as Apple hopes).

To be sure, the broad-based hardware platform needed by consumers is quickly coming into place. In effect, Apple Inc. (NASDAQ:AAPL) has begun to see saturation in the market for iPhones. Soon that could be the case for iPads, and eventually will be the case for its anticipated TV. Indeed, you could argue that a fully-saturated hardware base might mean outright revenue declines for Apple in this area.

Yet flat or declining sales for hardware will be more than offset by quickly-rising recurring software sales. In effect, the top-line growth is likely to cool, but a shift away from hardware should help margins, which means Apple’s bottom-line should keep growing at a solid clip. The challenge for management is to clearly articulate how profit margins for the anticipated TV sets will be so-so at best, but will lay the foundation for a compelling subscription service that carries recurring high-margin revenue. Once that happens, investors will be more able to see how Apple Inc. (NASDAQ:AAPL)’s per share profits, which are slated to rise from $44 in the fiscal year just ended to $58 a share by fiscal 2014, could move to $75 a share by later in the decade.