Looking for high-potential stocks? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 7.6% in the 12 months ending November 21, with more than 51% of the stocks in the index failing to beat the benchmark. Therefore, the odds that one will pin down a winner by randomly picking a stock are less than the odds in a fair coin-tossing game. Conversely, best performing hedge funds’ 30 preferred mid-cap stocks generated a return of 18% during the same 12-month period. Coincidence? It might happen to be so, but it is unlikely. Our research covering a 17-year period indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Apple Inc. (NASDAQ:AAPL).

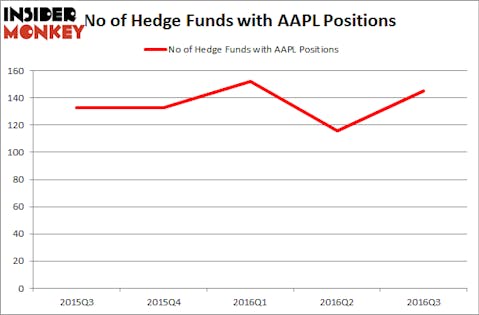

Apple Inc. (NASDAQ:AAPL) was in 145 hedge funds’ portfolios at the end of the third quarter of 2016. AAPL investors should be aware of an increase in enthusiasm from smart money recently. There were 116 hedge funds in our database with AAPL holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly valued stocks. That’s why at the end of this article we will examine companies such as Alphabet Inc (NASDAQ:GOOGL) and Microsoft Corporation (NASDAQ:MSFT) to gather more data points.

Follow Apple Inc. (NASDAQ:AAPL)

Follow Apple Inc. (NASDAQ:AAPL)

Receive real-time insider trading and news alerts

In the eyes of most stock holders, hedge funds are seen as slow, outdated investment tools of yesteryear. While there are more than 8000 funds in operation at the moment, Our experts hone in on the bigwigs of this group, about 700 funds. These money managers command the lion’s share of all hedge funds’ total asset base, and by tracking their first-class investments, Insider Monkey has uncovered a number of investment strategies that have historically outstripped the market. Insider Monkey’s small-cap hedge fund strategy defeated the S&P 500 index by 12 percentage points per year for a decade in its back tests.

Copyright: dennizn / 123RF Stock Photo

Keeping this in mind, we’re going to take a peek at the latest action regarding Apple Inc. (NASDAQ:AAPL).

What have hedge funds been doing with Apple Inc. (NASDAQ:AAPL)?

At Q3’s end, a total of 145 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 25% from the second quarter of 2016. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

Now, key hedge funds have jumped into Apple Inc. (NASDAQ:AAPL) headfirst. Coatue Management, managed by Philippe Laffont, created the most outsized position in Apple Inc. (NASDAQ:AAPL). Coatue Management had $735 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $623.8 million position during the quarter. The other funds with brand new AAPL positions are Aaron Cowen’s Suvretta Capital Management, Dan Loeb’s Third Point, and Lee Ainslie’s Maverick Capital.

Let’s go over hedge fund activity in other stocks that are similarly valued. These stocks are Alphabet Inc (NASDAQ:GOOGL), Microsoft Corporation (NASDAQ:MSFT), and Exxon Mobil Corporation (NYSE:XOM). This group of stocks’ market caps are similar to AAPL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GOOGL | 137 | 14788520 | 2 |

| GOOG | 134 | 14227250 | 8 |

| MSFT | 126 | 18140293 | -5 |

| XOM | 59 | 2828791 | -1 |

As you can see these stocks had an average of 114 hedge funds with bullish positions and the average amount invested in these stocks was $12.5 billion. That figure was $16.2 billion in AAPL’s case. Alphabet Inc (NASDAQ:GOOGL) is the most popular stock in this table. On the other hand Exxon Mobil Corporation (NYSE:XOM) is the least popular one with only 59 bullish hedge fund positions. Compared to these stocks Apple Inc. (NASDAQ:AAPL) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio. We should note that this isn’t a universally shared opinion. Today one of our writers published an article that listed 8 reasons why Apple is doomed.