The financial regulations require hedge funds and wealthy investors that exceeded the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on September 30th, about a month before the elections. We at Insider Monkey have made an extensive database of more than 817 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Air Products & Chemicals, Inc. (NYSE:APD) based on those filings.

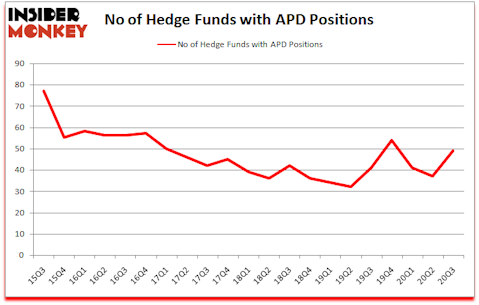

Is APD a good stock to buy now? Air Products & Chemicals, Inc. (NYSE:APD) shareholders have witnessed an increase in hedge fund sentiment of late. Air Products & Chemicals, Inc. (NYSE:APD) was in 49 hedge funds’ portfolios at the end of September. The all time high for this statistic is 77. There were 37 hedge funds in our database with APD positions at the end of the second quarter. Our calculations also showed that APD isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are tons of metrics market participants can use to appraise stocks. A pair of the most useful metrics are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the best picks of the elite money managers can beat their index-focused peers by a very impressive margin (see the details here).

Phillip Gross of Adage Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this cannabis tech stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now let’s go over the latest hedge fund action surrounding Air Products & Chemicals, Inc. (NYSE:APD).

Do Hedge Funds Think APD Is A Good Stock To Buy Now?

At the end of September, a total of 49 of the hedge funds tracked by Insider Monkey were long this stock, a change of 32% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in APD over the last 21 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Suvretta Capital Management, managed by Aaron Cowen, holds the most valuable position in Air Products & Chemicals, Inc. (NYSE:APD). Suvretta Capital Management has a $140.1 million position in the stock, comprising 2.5% of its 13F portfolio. Coming in second is Adage Capital Management, managed by Phill Gross and Robert Atchinson, which holds a $77.8 million position; 0.2% of its 13F portfolio is allocated to the company. Some other peers that are bullish comprise Cliff Asness’s AQR Capital Management, Robert Pohly’s Samlyn Capital and Greg Poole’s Echo Street Capital Management. In terms of the portfolio weights assigned to each position Sandbar Asset Management allocated the biggest weight to Air Products & Chemicals, Inc. (NYSE:APD), around 8.49% of its 13F portfolio. SAYA Management is also relatively very bullish on the stock, dishing out 5.31 percent of its 13F equity portfolio to APD.

As industrywide interest jumped, key money managers have jumped into Air Products & Chemicals, Inc. (NYSE:APD) headfirst. Suvretta Capital Management, managed by Aaron Cowen, initiated the most outsized position in Air Products & Chemicals, Inc. (NYSE:APD). Suvretta Capital Management had $140.1 million invested in the company at the end of the quarter. Robert Pohly’s Samlyn Capital also made a $53 million investment in the stock during the quarter. The following funds were also among the new APD investors: Alexander Mitchell’s Scopus Asset Management, Matthew Hulsizer’s PEAK6 Capital Management, and Louis Bacon’s Moore Global Investments.

Let’s now take a look at hedge fund activity in other stocks similar to Air Products & Chemicals, Inc. (NYSE:APD). We will take a look at Duke Energy Corporation (NYSE:DUK), Uber Technologies, Inc. (NYSE:UBER), The Sherwin-Williams Company (NYSE:SHW), Activision Blizzard, Inc. (NASDAQ:ATVI), Cigna Corporation (NYSE:CI), Illinois Tool Works Inc. (NYSE:ITW), and NetEase, Inc (NASDAQ:NTES). This group of stocks’ market values match APD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DUK | 36 | 756631 | 3 |

| UBER | 100 | 5978770 | 6 |

| SHW | 55 | 1779583 | 2 |

| ATVI | 93 | 4222431 | -4 |

| CI | 62 | 2751729 | -10 |

| ITW | 39 | 565865 | 4 |

| NTES | 45 | 3666807 | 7 |

| Average | 61.4 | 2817402 | 1.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 61.4 hedge funds with bullish positions and the average amount invested in these stocks was $2817 million. That figure was $745 million in APD’s case. Uber Technologies, Inc. (NYSE:UBER) is the most popular stock in this table. On the other hand Duke Energy Corporation (NYSE:DUK) is the least popular one with only 36 bullish hedge fund positions. Air Products & Chemicals, Inc. (NYSE:APD) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for APD is 39.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 32.9% in 2020 through December 8th and surpassed the market again by 16.2 percentage points. Unfortunately APD wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); APD investors were disappointed as the stock returned -9.9% since the end of September (through 12/8) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Air Products & Chemicals Inc. (NYSE:APD)

Follow Air Products & Chemicals Inc. (NYSE:APD)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.