The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their September 30 holdings, data that is available nowhere else. Should you consider Apartment Investment and Management Co. (NYSE:AIV) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

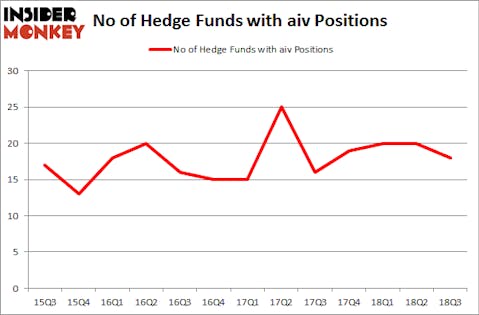

Apartment Investment and Management Co. (NYSE:AIV) investors should pay attention to a decrease in hedge fund interest recently. AIV was in 18 hedge funds’ portfolios at the end of the third quarter of 2018. There were 20 hedge funds in our database with AIV holdings at the end of the previous quarter. Our calculations also showed that aiv isn’t among the 30 most popular stocks among hedge funds.

At the moment there are several signals stock traders employ to analyze stocks. A duo of the most useful signals are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the best fund managers can trounce the S&P 500 by a solid amount (see the details here).

Let’s take a gander at the key hedge fund action regarding Apartment Investment and Management Co. (NYSE:AIV).

How are hedge funds trading Apartment Investment and Management Co. (NYSE:AIV)?

At Q3’s end, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, a change of -10% from the previous quarter. On the other hand, there were a total of 19 hedge funds with a bullish position in AIV at the beginning of this year. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in Apartment Investment and Management Co. (NYSE:AIV), which was worth $270.1 million at the end of the third quarter. On the second spot was Long Pond Capital which amassed $180.5 million worth of shares. Moreover, Balyasny Asset Management, D E Shaw, and Waterfront Capital Partners were also bullish on Apartment Investment and Management Co. (NYSE:AIV), allocating a large percentage of their portfolios to this stock.

Seeing as Apartment Investment and Management Co. (NYSE:AIV) has faced falling interest from the aggregate hedge fund industry, logic holds that there exists a select few hedge funds that elected to cut their entire stakes last quarter. At the top of the heap, Michael Platt and William Reeves’s BlueCrest Capital Mgmt. cut the biggest investment of the 700 funds followed by Insider Monkey, totaling an estimated $2 million in stock. George Hall’s fund, Clinton Group, also sold off its stock, about $1.6 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest fell by 2 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Apartment Investment and Management Co. (NYSE:AIV) but similarly valued. We will take a look at Teradyne, Inc. (NASDAQ:TER), W.P. Carey Inc. (NYSE:WPC), Xerox Corporation (NYSE:XRX), and Caesars Entertainment Corp (NASDAQ:CZR). This group of stocks’ market caps are similar to AIV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TER | 25 | 524936 | 0 |

| WPC | 10 | 23000 | -4 |

| XRX | 37 | 1216394 | 0 |

| CZR | 62 | 4321459 | 4 |

| Average | 33.5 | 1521447 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.5 hedge funds with bullish positions and the average amount invested in these stocks was $1.52 billion. That figure was $641 million in AIV’s case. Caesars Entertainment Corp (NASDAQ:CZR) is the most popular stock in this table. On the other hand W.P. Carey Inc. (NYSE:WPC) is the least popular one with only 10 bullish hedge fund positions. Apartment Investment and Management Co. (NYSE:AIV) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CZR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.