We recently compiled a list of the 12 Best Internet of Things Stocks To Buy According to Analysts. In this article, we are going to take a look at where Analog Devices, Inc. (NASDAQ:ADI) stands against the other IoT stocks.

Trends and Outlook for The Internet of Things Industry

According to the IOT analytics, 2024 was a poor year for the Internet of Things sector, particularly due to the headwinds from the hardware sector. As per the report published on January 15, many IoT-centric industries experienced stunted year-over-year growth. The industrial software market grew 12% year-over-year, slightly slower than the growth in 2023, whereas the industrial hardware industry experienced market declines. However, despite the slowdown the number of IoT connected devices grew around 13% year-over-year, surpassing 18 billion. In addition, the expertise spending related to IoT also increased by 10% year-over-year to reach $298 billion in 2024. The report also highlighted that the discussion on IoT remained high among leading CEO’s of the technology industry. The public relevance of the term Internet of Things remained within 30% of its all-time high in 2022.

Read Next: 10 Worst Performing Bank Stocks in 2024 and 12 Best FMCG Stocks To Buy According to Hedge Funds.

Moreover, another report by McKinsey & Company states that IoT can offer significant economic value potential. The report highlights that IoT can unlock $5.5 trillion to $12.6 trillion in economic value by consumer IoT products and services. McKinney & Company predicts that the most economic value of the technology will come from its deployment in industrial environments including manufacturing, health care, and other areas. Factory setting is expected to be the largest beneficiary by generating around $1.4 trillion to $3.3 trillion by 2030, or 26% of the total value. Lastly, the perceived value of IoT, the technological advancements, and the emergence of 5G in Networking are anticipated to be the prominent tailwinds for the sector.

Our Methodology

To compile the list of the 12 best Internet of Things stocks to buy according to analysts we used the Global X Internet of Things ETF. Using the ETF we aggregated a list of IoT stocks with positive analyst upside potential (at least 10%), sourced from CNN. Lastly, we ranked the stocks in ascending order of the analyst upside potential. Please note that the data was retrieved on Monday, 17th February, 2025.

Why do we care about what hedge funds do? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

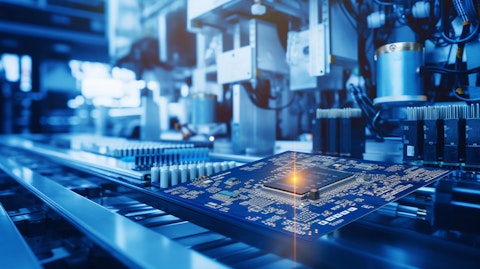

A technician working on power management in a semiconductor factory.

Analog Devices, Inc. (NASDAQ:ADI)

Analyst Upside Potential: 18.82%

Analog Devices, Inc. (NASDAQ:ADI) is a global semiconductor company that creates and sells electronic components and systems. These electronic systems become key components for implementing Internet of Things systems as they combine analog, digital, and software technologies together. Its products include integrated circuits, which are used in data conversion, amplifying signals, managing power in devices, handling radio frequencies for communication devices, and creating sensors that detect changes in the environment.

On February 14, Tore Svanberg, an analyst at Stifel Nicolaus, maintained a Buy rating on the stock with a price target of $275. Analog Devices, Inc. (NASDAQ:ADI) despite facing challenges from customer inventory issues in fiscal 2024 was able to exceed revenue and profitability above the midpoint guidance. Moreover, it maintained operating margins above 40%, showcasing the resilience of its business model even during difficult times. In addition, Analog Devices, Inc. (NASDAQ:ADI) continued making strategic investments in engineering, manufacturing, and enhancing the customer experience to position itself for long-term success. Looking ahead, the company projects revenue of $2.35 billion for the fiscal first quarter of 2025. It is one of the best Internet of Things stocks to buy according to analysts.

Carillon Eagle Growth & Income Fund stated the following regarding Analog Devices, Inc. (NASDAQ:ADI) in its Q2 2024 investor letter:

“Analog Devices, Inc. (NASDAQ:ADI) rebounded as management teams at several semiconductor companies in the analog space called the bottom, seeing improved conditions ahead. The analog semiconductor industry is a very cyclical business that has underperformed the broader semiconductor industry for several years.”

Overall ADI ranks 7th on our list of the best IoT stocks to buy according to analysts. While we acknowledge the potential of ADI as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than ADI but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and Complete List of 59 AI Companies Under $2 Billion in Market Cap.

Disclosure: None. This article is originally published at Insider Monkey.