We recently published a list of 10 Undervalued Semiconductor Stocks to Buy According to Analysts. In this article, we are going to take a look at where Amkor Technology, Inc. (NASDAQ:AMKR) stands against other undervalued semiconductor stocks to buy according to analysts.

Global market intelligence firm IDC, in its most recent report, projected a 15% growth for the global semiconductor market in 2025, driven by the relentless rise in demand for artificial intelligence (AI) and high-performance computing (HPC). According to their analysts, this surge will be fueled by forthcoming upgrades in key application markets, notably cloud data centers. Further emphasizing the industry’s promising growth outlook, Nicolas Gaudois, head of Asia-Pacific technology research at UBS, stated in a recent CNBC interview that AI-compute will continue to underpin growth in 2025. He observed:

“The 21% growth in the semiconductor market was mostly driven by AI-compute demand while non-AI growth actually declined. In 2025, AI would remain the growth driver with 40% growth but we expect non-AI portion to also grow by 17% due to several factors such as autos and industrial markets growth improving, restocking (customers buying for their inventories) in those markets and also increase in semiconductor content in devices to support edge (on-device) AI.”

Nicolas also suggested that GPU chipmakers and foundries will remain the main beneficiaries of AI demand and will make the most money from it. With the semiconductor space ripe for further growth, we have picked 10 semiconductor stocks that are undervalued and are best placed to benefit from this growth.

Our Methodology

To identify the 10 undervalued semiconductor stocks, we carried out thorough research and used stock screeners to compile a list of U.S.-listed companies. Our criteria included a market capitalization of over $2 billion, an expected share price upside of at least 10%, and a Forward PE ratio below 30x. Ultimately, the stocks were ranked in ascending order of their upside potential. These stocks are also popular among elite hedge funds.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

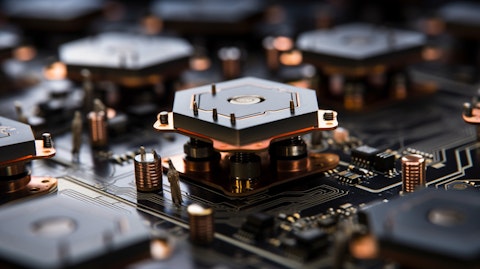

A close up of a micro-electro-mechanical systems (MEMS) package awaiting testing.

Amkor Technology, Inc. (NASDAQ:AMKR)

Upside Potential: 28%

Fwd. PE: 19.4

Amkor Technology, Inc. (NASDAQ:AMKR) holds the title as the world’s largest provider of outsourced semiconductor assembly and test (OSAT) services. The company caters to a diverse range of industries, including communication, automotive, industrial, computing, and consumer sectors, providing manufacturing services for products such as smartphones, electric vehicles, data centers, artificial intelligence, and wearables. Amkor Technology, Inc.’s (NASDAQ:AMKR) growth profile is strongly supported by the rapidly evolving sectors of generative AI, automotive electrification, and connected devices. With the ever-increasing demand for chips in these areas, the company is advantageously placed as packaging and testing are critical components of the semiconductor supply chain.

Amkor Technology, Inc. (NASDAQ:AMKR) is prioritizing design engagement with original equipment manufacturers (OEMs) and semiconductor companies to enhance packaging innovation. In October 2024, the company made a strategic move by signing an agreement with Taiwanese foundry player TSMC to collaborate and bring advanced packaging and test capabilities to Arizona. Under this agreement, TSMC will utilize Amkor Technology, Inc.’s (NASDAQ:AMKR) services at its planned facility in Peoria, Arizona, as well as leverage these services for its customers at its Phoenix facility. Amkor Technology, Inc. (NASDAQ:AMKR) is executing its expansion plan effectively, with approximately 11%-12% of its annual sales allocated to expansion capital expenditures.

Overall, AMKR ranks 5th on our list of undervalued semiconductor stocks to buy according to analysts. While we acknowledge the potential of AMKR to grow, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than AMKR but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and Complete List of 59 AI Companies Under $2 Billion in Market Cap

Disclosure: None. This article is originally published at Insider Monkey.