Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track more than 700 prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ recent losses in Facebook. Let’s take a closer look at what the funds we track think about AMC Entertainment Holdings Inc (NYSE:AMC) in this article.

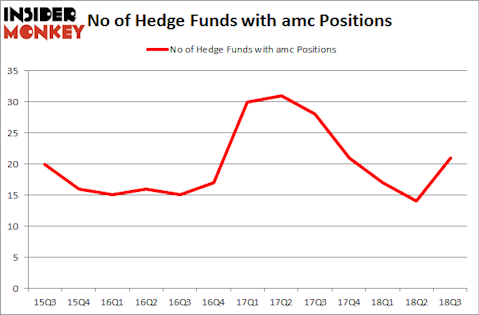

AMC Entertainment Holdings Inc (NYSE:AMC) investors should pay attention to an increase in hedge fund interest lately. Our calculations also showed that amc isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a look at the new hedge fund action surrounding AMC Entertainment Holdings Inc (NYSE:AMC).

What does the smart money think about AMC Entertainment Holdings Inc (NYSE:AMC)?

At Q3’s end, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 50% from the previous quarter. The graph below displays the number of hedge funds with bullish position in AMC over the last 13 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Baupost Group, managed by Seth Klarman, holds the most valuable position in AMC Entertainment Holdings Inc (NYSE:AMC). Baupost Group has a $56 million position in the stock, comprising 0.4% of its 13F portfolio. The second largest stake is held by Christian Leone of Luxor Capital Group, with a $29.2 million position; the fund has 0.7% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that are bullish consist of Jim Simons’s Renaissance Technologies, Lee Ainslie’s Maverick Capital and Noam Gottesman’s GLG Partners.

Consequently, key hedge funds have been driving this bullishness. Renaissance Technologies, managed by Jim Simons, established the most outsized position in AMC Entertainment Holdings Inc (NYSE:AMC). Renaissance Technologies had $21.4 million invested in the company at the end of the quarter. Jack Ripsteen’s Potrero Capital Research also initiated a $5.8 million position during the quarter. The following funds were also among the new AMC investors: D. E. Shaw’s D E Shaw, Malcolm Fairbairn’s Ascend Capital, and John M. Angelo and Michael L. Gordon’s Angelo Gordon & Co.

Let’s now review hedge fund activity in other stocks similar to AMC Entertainment Holdings Inc (NYSE:AMC). These stocks are Crestwood Equity Partners LP (NYSE:CEQP), HB Fuller Co (NYSE:FUL), Halozyme Therapeutics, Inc. (NASDAQ:HALO), and Valero Energy Partners LP (NYSE:VLP). All of these stocks’ market caps match AMC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CEQP | 4 | 35008 | -2 |

| FUL | 8 | 137229 | -5 |

| HALO | 21 | 294565 | 2 |

| VLP | 3 | 8387 | 1 |

| Average | 9 | 118797 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $119 million. That figure was $159 million in AMC’s case. Halozyme Therapeutics, Inc. (NASDAQ:HALO) is the most popular stock in this table. On the other hand Valero Energy Partners LP (NYSE:VLP) is the least popular one with only 3 bullish hedge fund positions. AMC Entertainment Holdings Inc (NYSE:AMC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HALO might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.