Amazon.com Inc (NASDAQ:AMZN) ranks 2nd on our list of Top 10 AI Stocks for 2024 According to Billionaire David Tepper.

Before analyzing the stock, let’s first see David Tepper’s latest returns and his investing strategy for 2024.

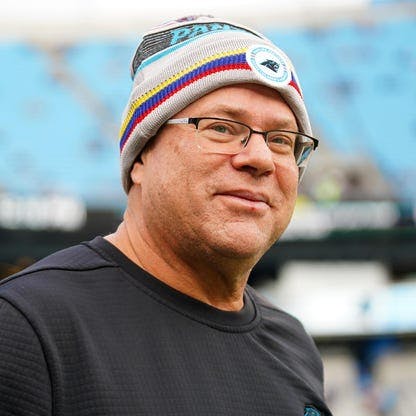

Billionaire David Tepper of Appaloosa Management recently made headlines when his latest portfolio showed the 66-year-old owner of Carolina Panthers was piling into Chinese stocks while clearly cutting his exposure to mega-cap tech stocks which have already rewarded him heftily over the past several quarters, thanks to the AI-led rally. Tepper’s bet on Chinese stocks comes at a time when many analysts are predicting a rebound of Chinese economy as the government begins to devise more rescue plans for the devastated property sector. The MSCI China index is up about 10% since the end of March.

David Tepper’s Returns

David Tepper, who founded Appaloosa Management back in 1993, returned 20% last year, thanks to his huge stake in AI stocks. A cursory analysis of David Tepper, worth over $20 billion, shows that he was piling into AI stocks when they were just getting started. This wasn’t a fluke or a one-off success from the billionaire. Data from Bloomberg shows that Tepper has posted annualized returns of 28% for investors, before fees. In 2022, when markets were tumbling amid inflation storm and rising interest rates, Appaloosa returned 12.5%. Tepper’s instincts and grip over financial markets were strong even when he was in his late 20s and 30s, raking in huge profits for Goldman Sachs, which he’d joined in 1985.

Tepper rose to fame at Goldman when his portfolio stood out in the mist of the market crash of 1987. According to The Alpha Masters: Unlocking the Genius of the World’s Top Hedge Funds, written by Maneet Ahuja, Tepper recalled:

“Going into the crash I had set up my entire portfolio as just short—I had no long positions. I made a fortune during and after the crash,” he says with a chuckle. “It was very cool.” Unfortunately, the rest of the firm didn’t do as well. “I still got a raise but not as much as I should have.”

Amazon.com Inc (NASDAQ:AMZN)

Billionaire David Tepper Q1’2024 Stake Value: $690,494,640

Billionaire David Tepper owns a $690 million stake in Amazon.com Inc (NASDAQ:AMZN) as of the end of the first quarter of 2024. Amazon Web Services business has become an AI powerhouse as companies use the Cloud platform to develop, deploy and maintain their AI applications.

Amazon.com Inc (NASDAQ:AMZN) saw a sharp increase in hedge fund sentiment in the first quarter of 2024. A total of 302 hedge funds out of the 919 funds in Insider Monkey’s database now own stakes in Amazon.com Inc (NASDAQ:AMZN), up from 293 hedge funds in the previous quarter.

Vulcan Value Partners stated the following regarding Amazon.com, Inc. (NASDAQ:AMZN) in its first quarter 2024 investor letter:

“Amazon.com, Inc. (NASDAQ:AMZN) is a dominant, world class company with powerful secular tailwinds in place including its ecommerce penetration, digital advertising growth, and the cloud transition. Amazon reported strong results during the quarter. Losses in the Core Retail business significantly narrowed. Amazon reduced its cost to serve on a per unit basis for the first time since 2018 as the company’s recent regionalization efforts continue to bear fruit.”

Amazon.com Inc (NASDAQ:AMZN) ranks 2nd on our list of Top 10 AI Stocks for 2024 According to Billionaire David Tepper.

Click to see more AI stock picks of billionaire Tepper by clicking 10 Best AI Stock Picks of David Tepper for 2024.

If you are looking for an AI stock that is as promising as Microsoft but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: Michael Burry Is Selling These Stocks and Opportunities in Uranium Stocks.

Disclosure: None. This article is originally published at Insider Monkey.