We recently published a list of 10 Best Automation Stocks to Buy Now. In this article, we are going to take a look at where Alphabet Inc. (NASDAQ:GOOGL) stands against the other automation stocks.

2023 was the year of generative AI, mainly because of the widespread adoption of ChatGPT and the resulting response that followed. Now, 2024 is the year in which companies have truly started using this ever-evolving technology. McKinsey revealed that AI supported the companies in both aspects: cost decreases and revenue jumps.

Automation Technologies- Key Trends

In 2024, the integration of automation technologies continues to revolutionize every aspect of supply chain management. This led to unprecedented levels of efficiency and agility. The global integrated automated supply chain is expected to reach US$25.6 billion by 2033, from US$13.4 billion in 2023, according to industry data by Market.us.

From removing warehousing bottlenecks to inventory management and demand forecasting, supply chain automation reshaped traditional practices and redefined the dynamics of the logistics industry. In inventory tracking, advanced warehouse management systems, which are powered by AI and ML algorithms, focus on optimizing inventory placement, route planning, resource allocation, etc.

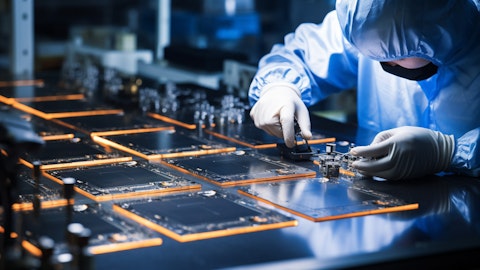

Inventory tracking and management are being revolutionized through the usage of automation solutions, such as RFID tagging, barcode scanning, and computer vision. Real-time tracking technologies are offering granular visibility in inventory movements. This allows businesses to monitor stock levels, spot discrepancies, and manage understocking/overstocking. Manufacturers are now getting inclined towards smart factories.

Smart factories reflect and demonstrate Industry 4.0 principles. They tend to leverage 5G, IoT, AI, and other advanced technologies. Experts believe that smart factories allow predictive maintenance and decision-making.

Adoption of Advanced Automation

A new theme is emerging in the field of automation, which is automated decision-making. Its adoption rapidly expanded beyond traditional sectors such as manufacturing and logistics. Demand for decision intelligence stems from data-driven and well-informed decision-making requirements which enhances corporate competitiveness and efficiency.

Automated decision-making is now being accepted by critical domains including healthcare and finance. In healthcare, automation supplements the clinical decision-making processes, improves patient-care delivery, and manages resource allocation. It involves leveraging AI and ML algorithms to assess patient data, medical images, and genomic sequences, and customize patient care.

Likewise, in finance, automated systems continue to reshape top-notch operations like risk assessment, fraud detection, and investment management. AI algorithms assess large datasets of financial transactions and market trends to optimize investment strategies. In 2024, the software development industry is all set to embark on a remarkable transformation with cutting-edge innovations.

Quantum Computing and Robotics

The latest technologies in software that are expected to reshape the landscape include quantum computing, virtual reality (VR), augmented reality (AR), big data, data analytics, 5G technology, robotics, etc.

Quantum computing continues to rapidly advance, evolve, and reshape scientific and industrial landscapes. Unlike classical computers—which use bits as the smallest information unit—quantum computers make use of qubits. These exploit quantum mechanics principles to perform complex and difficult calculations. For example, at the time of drug discovery, quantum algorithms simulate molecular interactions in a more accurate and refined way as compared to traditional methods. The integration of quantum computing with AI is another critical emerging trend.

The unprecedented advancements in robotics and AI are expected to bring revolutionary positive transformations. More and more sectors continue to understand the benefits of adopting robotics and AI. Globally, the robotics market should achieve healthy revenue growth, with a projected value of US$38.24 billion this year. The strongest segment in the robotics market is expected to be service robotics, which should lead in market volume. Service robotics find its application in sectors, like Healthcare, Medical, Military and Defense, Logistics, etc. while industrial robots are used in Automotive, Electronics, Food & Beverage, etc.

The trends driving the robotics market are supported by developments in emerging technologies. These include 5G, AI, Edge Computing, IIoT, cloud, open-source, etc. Since AI in robotics continues to evolve, more and more industries are exploiting the latest technologies. Therefore, manufacturers are making data-driven decisions. Some industries use self-learning robots to execute work processes.

Smart factories are using AI-enabled robotics to execute smarter, reliable, and efficient processes. They help in production optimization. AI-powered robotic technologies, which include computer vision and tactile sensing, are utilized to help automate certain tasks. For example, reinforcement learning is used for better industrial assembly. The adoption of robotics, smart automation, and high-tech manufacturing will help workers with manual labor and reduce repetitive tasks.

At Insider Monkey we are obsessed with the stocks that hedge funds pile into. The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

A user’s hands typing a search query into a Google Search box, emphasizing the company’s search capabilities.

Alphabet Inc. (NASDAQ:GOOGL)

Average Upside Potential: 23.95%

Alphabet Inc. (NASDAQ:GOOGL) operates as a holding company. With the help of its subsidiaries, the company offers web-based searches, advertisements, maps, software applications, enterprise solutions, commerce, and hardware products.

UiPath Inc. (NYSE:PATH), which is a leading enterprise automation and AI software company, and Google Cloud announced an expanded partnership to help customers transform their enterprise with AI-powered automation. UiPath is now available on Google Cloud Marketplace. Therefore, Google Cloud customers can purchase UiPath Business Automation Platform. This will help them reliably deploy and scale automation initiatives on Google Cloud infrastructure.

Google Cloud’s expanding partnership with UiPath Inc. (NYSE:PATH) should create new opportunities for businesses as they will be able to streamline thousands of processes with AI and automation. These businesses will save costs and unlock new innovation.

The company has released its 2Q 2024 financial results, with total revenues coming at $84.7 billion. Of this, more than ~75% was contributed from advertising on Google Search and its other channels. As of now, investors are in a dicey situation as to what should be the next course of action after the recent Antitrust Defeat. For those who are unaware, Alphabet Inc. (NASDAQ:GOOGL), which is the parent company of Google, lost an antitrust lawsuit in Federal court.

The $20 billion in annual payments to Apple Inc. (NASDAQ:AAPL), made by Alphabet Inc. (NASDAQ:GOOGL), for making Google the default search engine made the critical part of the case. The judge provided a ruling, wherein, he said that Alphabet Inc. (NASDAQ:GOOGL) illegally stifled competition in its online search market.

Even though this ruling is a major setback for the company, it should be noted that Alphabet Inc. (NASDAQ: GOOGL) pays billions of dollars to several other companies. These are made to make Google Search the default search engine. Since the tech giant will not pay anymore, this can help the company save billions of dollars per year. Even though it is believed that the appeals process will take several years, Google’s search market share should not reduce quickly. Apart from this, the company has included artificial intelligence features in Google. Because of this, it has collected massive amounts of user data. In 2Q 2024, the company’s capital spending went up by 91% to reach $13.18 billion. The company is playing the long game when it comes to incorporating Al-powered technologies.

Analysts at Truist Financial upped their price objective on shares of Alphabet Inc. (NASDAQ:GOOGL) from $190.00 to $196.00. They have a “Buy” rating on 24th July.

According to Insider Monkey’s 1Q 2024, Alphabet Inc. (NASDAQ:GOOGL) was part of 222 hedge fund portfolios, compared to 214 in the last quarter.

Patient Capital Management, a value investing firm, released its 2Q 2024 investor letter and mentioned Alphabet Inc. (NASDAQ:GOOGL). Here is what the fund said:

“Alphabet Inc. (NASDAQ:GOOGL) was a top contributor in the second quarter, finally catching up to its peers in the Magnificent 7. The company gained 20.8% in the period following strong first quarter earnings, a new $70B repurchase program (3% of shares outstanding) and the initiation of a cash dividend ($0.20 per share; 0.42% yield). We continue to believe the market underappreciates Google’s exposure to AI with its Gemini model being integrated into search results, YouTube advertising and its cloud offering. We continue to think that the cloud players will be the AI winners in the long-term, with Google being well positioned to take advantage. While the company trades at 24x 2024 earnings, if you remove the money-losing and under-earning businesses, you realize that you are paying below a market multiple for the core Google business. We do not believe there are many other AI winners trading at such an attractive multiple.”

Overall, GOOGL ranks 9th on our list of best automation stocks to buy. While we acknowledge the potential of GOOGL as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than GOOGL but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: $30 Trillion Opportunity: 15 Best Humanoid Robot Stocks to Buy According to Morgan Stanley and Jim Cramer Says NVIDIA ‘Has Become A Wasteland’.

Disclosure: None. This article is originally published at Insider Monkey.