Based on the fact that hedge funds have collectively under-performed the market for several years, it would be easy to assume that their stock picks simply aren’t very good. However, our research shows this not to be the case. In fact, when it comes to their very top picks collectively, they show a strong ability to pick winning stocks. This year hedge funds’ top 30 stock picks at the end of September easily bested the broader market, at 6.7% compared to 2.6%, despite there being a few duds in there like Facebook (even their collective wisdom isn’t perfect). The results show that there is plenty of merit to imitating the collective wisdom of top investors.

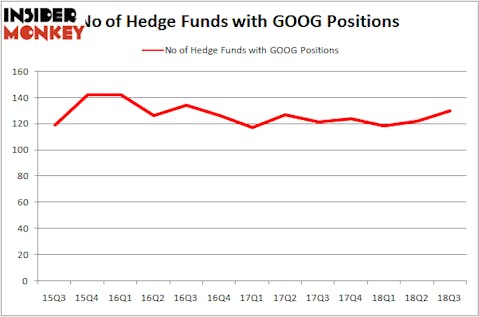

Is Alphabet Inc. (NASDAQ:GOOG) a good stock to buy now? Hedge funds are taking an optimistic view. The number of bullish hedge fund positions inched up by 8 lately. GOOG was in 130 hedge funds’ portfolios at the end of the third quarter of 2018. There were 122 hedge funds in our database with GOOG positions at the end of the previous quarter. Overall, GOOG was still the fifth most popular stock among hedge funds (check out the list of 30 most popular stocks among hedge funds now). Billionaire hedge fund managers were slightly less bullish as GOOG ranked #10 in the list of 30 stocks billionaires are crazy about.

We’re going to review the new hedge fund action regarding Alphabet Inc. (NASDAQ:GOOG).

How are hedge funds trading Alphabet Inc. (NASDAQ:GOOG)?

At Q3’s end, a total of 130 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from the second quarter of 2018. By comparison, 124 hedge funds held shares or bullish call options in GOOG heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Eagle Capital Management held the most valuable stake in Alphabet Inc. (NASDAQ:GOOG), which was worth $1932.9 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $1157.5 million worth of shares. Moreover, Lone Pine Capital, Orbis Investment Management, and billionaire Stan Druckenmiller were also bullish on Alphabet Inc. (NASDAQ:GOOG), allocating a large percentage of their portfolios to this stock. Below we shared why Druckenmiller likes Alphabet so much.

As industrywide interest jumped, key money managers were breaking ground themselves. Hound Partners, managed by Jonathan Auerbach, established the most valuable position in Alphabet Inc. (NASDAQ:GOOG). Hound Partners had $89.5 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also initiated a $61.9 million position during the quarter. The other funds with brand new GOOG positions are Gregg Moskowitz’s Interval Partners, John Hurley’s Cavalry Asset Management, and Ian Simm’s Impax Asset Management.

Let’s go over hedge fund activity in other stocks similar to Alphabet Inc. (NASDAQ:GOOG). We will take a look at Berkshire Hathaway Inc. (NYSE:BRK-B), Facebook, Inc. (NASDAQ:FB), Alibaba Group Holding Ltd (NYSE:BABA), and JPMorgan Chase & Co. (NYSE:JPM). This group of stocks’ market values resemble GOOG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BRK-B | 84 | 24061146 | 3 |

| FB | 164 | 16604320 | -29 |

| BABA | 127 | 15116904 | 10 |

| JPM | 99 | 11436176 | 7 |

As you can see these stocks had an average of 118.5 hedge funds with bullish positions and the average amount invested in these stocks was $16.8 billion. That figure was $13.7 billion in GOOG’s case. Facebook, Inc. (NASDAQ:FB) is the most popular stock in this table. On the other hand Berkshire Hathaway Inc. (NYSE:BRK-B) is the least popular one with only 84 bullish hedge fund positions. Alphabet Inc. (NASDAQ:GOOG) is not the most popular stock in this group but hedge fund interest is still above average.

We just shared an 80 minute interview with Stan Druckenmiller on our site. Druckenmiller is bearish about the overall direction of the market, has been attempting to short the market earlier this summer, yet he says he can’t make himself sell Google. You can read his entire Alphabet Inc thesis on our site but basically he thinks the stock is way too cheap for a growth stock and a technology leader that is under earning in a lot of areas.

We actually agree with hedge funds and Druckenmiller who has been spot on with his comments about IBM and Amazon 3 years ago when Buffett and Einhorn disagreed with him. That’s why we believe Google is indeed a very promising long-term investment at these prices.

Disclosure: None. This article was originally published at Insider Monkey.