Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Alibaba Group Holding Ltd (NYSE:BABA)? The smart money sentiment can provide an answer to this question.

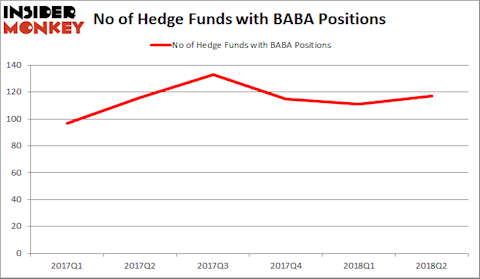

Is Alibaba Group Holding Ltd (NYSE:BABA) a buy here? On the surface money managers seem to be recently taking an optimistic view. The number of bullish hedge fund bets inched up by 6 recently. BABA was in 117 hedge funds’ portfolios at the end of June. There were 111 hedge funds in our database with BABA holdings at the end of the previous quarter. Collectively hedge funds owned only 3.2% of Alibaba’s outstanding shares though. Alibaba was actually the sixth most popular stock among hedge funds at the end of the second quarter (see the list of 25 most popular stocks among hedge funds).

At the moment there are dozens of formulas market participants have at their disposal to value their holdings. A duo of the less utilized formulas are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the elite investment managers can outperform the broader indices by a very impressive amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a peek at the fresh hedge fund action regarding Alibaba Group Holding Ltd (NYSE:BABA).

How have hedgies been trading Alibaba Group Holding Ltd (NYSE:BABA)?

Heading into the fourth quarter of 2018, a total of 117 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from the previous quarter. On the other hand, there were a total of 116 hedge funds with a bullish position in BABA at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Fisher Asset Management held the most valuable stake in Alibaba Group Holding Ltd (NYSE:BABA), which was worth $2 billions at the end of the second quarter. On the second spot was Hillhouse Capital Management which amassed $1.2 billions worth of shares. Moreover, Folger Hill Asset Management, Kadensa Capital, and Joho Capital were also bullish on Alibaba Group Holding Ltd (NYSE:BABA), allocating a large percentage of their portfolios to this stock.

Consequently, key hedge funds were leading the bulls’ herd. Asturias Capital, managed by Francis Cueto, created the most valuable position in Alibaba Group Holding Ltd (NYSE:BABA). Asturias Capital had $32.5 million invested in the company at the end of the quarter. Pasco Alfaro / Richard Tumure’s Miura Global Management also initiated a $25 million position during the quarter. The following funds were also among the new BABA investors: Alok Agrawal’s Bloom Tree Partners, Simon Sadler’s Segantii Capital, and Matthew Knauer and Mina Faltas’s Nokota Management.

Let’s go over hedge fund activity in other stocks similar to Alibaba Group Holding Ltd (NYSE:BABA). We will take a look at Berkshire Hathaway Inc. (NYSE:BRK-B), JPMorgan Chase & Co. (NYSE:JPM), Exxon Mobil Corporation (NYSE:XOM), and Johnson & Johnson (NYSE:JNJ). This group of stocks’ market values are similar to BABA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BRK-B | 81 | 20251117 | 3 |

| JPM | 92 | 7011260 | -8 |

| XOM | 50 | 2222523 | -7 |

| JNJ | 66 | 5711736 | -2 |

As you can see these stocks had an average of 72.25 hedge funds with bullish positions and the average amount invested in these stocks was $8.8 billion. That figure was $15.4 billion in BABA’s case. JPMorgan Chase & Co. (NYSE:JPM) is the most popular stock in this table. On the other hand Exxon Mobil Corporation (NYSE:XOM) is the least popular one with only 50 bullish hedge fund positions. Compared to these stocks Alibaba Group Holding Ltd (NYSE:BABA) is more popular among hedge funds.

However, there are a bigger group of hedge funds who are shorting more than 100 million Alibaba shares. This means, overall, the hedge fund community isn’t bullish about Alibaba even though the tech company has a lot of fans. Given that we are in an increasing interest rate environment and there is a trade war with China going on, we wouldn’t rush to initiate a new position in the stock.

Disclosure: None. This article was originally published at Insider Monkey.