We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Alamo Group, Inc. (NYSE:ALG).

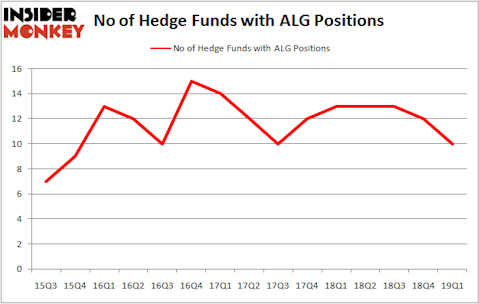

Alamo Group, Inc. (NYSE:ALG) investors should be aware of a decrease in activity from the world’s largest hedge funds recently. Our calculations also showed that ALG isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are dozens of indicators shareholders have at their disposal to size up stocks. Some of the most underrated indicators are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the elite fund managers can outperform the broader indices by a superb amount (see the details here).

Martin Whitman of Third Avenue Management

We’re going to check out the key hedge fund action surrounding Alamo Group, Inc. (NYSE:ALG).

What does smart money think about Alamo Group, Inc. (NYSE:ALG)?

Heading into the second quarter of 2019, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -17% from the fourth quarter of 2018. By comparison, 13 hedge funds held shares or bullish call options in ALG a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

More specifically, Longview Asset Management was the largest shareholder of Alamo Group, Inc. (NYSE:ALG), with a stake worth $169.9 million reported as of the end of March. Trailing Longview Asset Management was Royce & Associates, which amassed a stake valued at $11.4 million. Third Avenue Management, Millennium Management, and Arrowstreet Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Because Alamo Group, Inc. (NYSE:ALG) has faced a decline in interest from the aggregate hedge fund industry, we can see that there is a sect of fund managers who were dropping their entire stakes by the end of the third quarter. It’s worth mentioning that Phil Frohlich’s Prescott Group Capital Management sold off the biggest position of all the hedgies followed by Insider Monkey, totaling about $0.4 million in stock, and Minhua Zhang’s Weld Capital Management was right behind this move, as the fund dropped about $0.4 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest dropped by 2 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Alamo Group, Inc. (NYSE:ALG) but similarly valued. These stocks are 1-800-FLOWERS.COM, Inc. (NASDAQ:FLWS), Saul Centers Inc (NYSE:BFS), ARMOUR Residential REIT, Inc. (NYSE:ARR), and SemGroup Corp (NYSE:SEMG). All of these stocks’ market caps resemble ALG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FLWS | 19 | 88813 | 5 |

| BFS | 10 | 38051 | 3 |

| ARR | 8 | 73012 | 3 |

| SEMG | 13 | 46994 | 1 |

| Average | 12.5 | 61718 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $62 million. That figure was $196 million in ALG’s case. 1-800-FLOWERS.COM, Inc. (NASDAQ:FLWS) is the most popular stock in this table. On the other hand ARMOUR Residential REIT, Inc. (NYSE:ARR) is the least popular one with only 8 bullish hedge fund positions. Alamo Group, Inc. (NYSE:ALG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately ALG wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); ALG investors were disappointed as the stock returned 0.7% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.