It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The S&P 500 Index gained 7.6% in the 12 month-period that ended November 21, while less than 49% of its stocks beat the benchmark. In contrast, the 30 most popular mid-cap stocks among the top hedge fund investors tracked by the Insider Monkey team returned 18% over the same period, which provides evidence that these money managers do have great stock picking abilities. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like AgroFresh Solutions Inc (NASDAQ:AGFS).

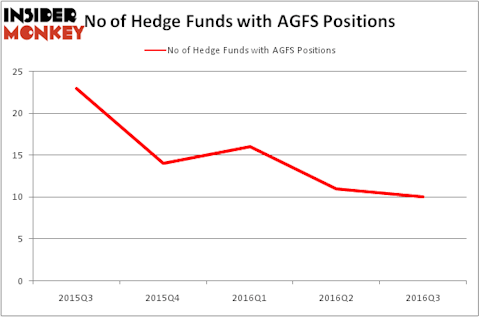

Is AgroFresh Solutions Inc (NASDAQ:AGFS) ready to rally soon? Money managers are definitely getting less optimistic. The number of long hedge fund investments fell by 1 recently. There were 10 hedge funds in our database with AGFS positions at the end of the third quarter. At the end of this article we will also compare AGFS to other stocks including Malibu Boats Inc (NASDAQ:MBUU), DSP Group, Inc. (NASDAQ:DSPG), and Pioneer Energy Services Corp (NYSE:PES) to get a better sense of its popularity.

Follow Agrofresh Solutions Inc. (NASDAQ:AGFS)

Follow Agrofresh Solutions Inc. (NASDAQ:AGFS)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Africa Studio/Shutterstock.com

What does the smart money think about AgroFresh Solutions Inc (NASDAQ:AGFS)?

At Q3’s end, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a drop of 9% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in AGFS over the last 5 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Pentwater Capital Management, led by Matthew Halbower, holds the most valuable position in AgroFresh Solutions Inc (NASDAQ:AGFS). Pentwater Capital Management has a $4.1 million position in the stock. On Pentwater Capital Management’s heels is Oskie Capital Management, led by David M. Markowitz, which holds a $4 million position; 2.2% of its 13F portfolio is allocated to the stock. Some other peers that hold long positions include David Brown’s Hawk Ridge Management, Jeffrey Bronchick’s Cove Street Capital and Matthew Halbower’s Pentwater Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now that we’ve mentioned the most bullish investors, let’s also take a look at some funds that cut their entire stakes in the stock during the third quarter. It’s worth mentioning that Jeffrey Jacobowitz’s Simcoe Capital Management cut the largest investment of the 700 funds followed by Insider Monkey, comprising close to $7.2 million in stock. Adam Wright and Gary Kohler’s fund, Blue Clay Capital, also said goodbye to its stock, about $0.2 million worth.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as AgroFresh Solutions Inc (NASDAQ:AGFS) but similarly valued. We will take a look at Malibu Boats Inc (NASDAQ:MBUU), DSP Group, Inc. (NASDAQ:DSPG), Pioneer Energy Services Corp (NYSE:PES), and Ignyta Inc (NASDAQ:RXDX). This group of stocks’ market values are similar to AGFS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MBUU | 14 | 15825 | 5 |

| DSPG | 12 | 58798 | 4 |

| PES | 10 | 4083 | -1 |

| RXDX | 16 | 94094 | 0 |

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $43 million. That figure was $12 million in AGFS’s case. Ignyta Inc (NASDAQ:RXDX) is the most popular stock in this table. On the other hand Pioneer Energy Services Corp (NYSE:PES) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks AgroFresh Solutions Inc (NASDAQ:AGFS) is even less popular than PES. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None