The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the fourth quarter, which unveil their equity positions as of December 31st. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Agnico Eagle Mines Limited (NYSE:AEM).

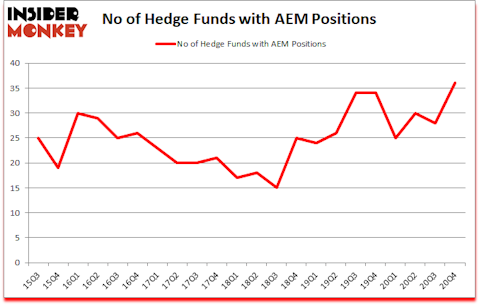

Is AEM stock a buy or sell? Agnico Eagle Mines Limited (NYSE:AEM) shareholders have witnessed an increase in enthusiasm from smart money in recent months. Agnico Eagle Mines Limited (NYSE:AEM) was in 36 hedge funds’ portfolios at the end of December. The all time high for this statistic is 34. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that AEM isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 124 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 13% through November 17th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Eric Sprott of Sprott Asset Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 10 best battery stocks to buy to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind let’s view the fresh hedge fund action surrounding Agnico Eagle Mines Limited (NYSE:AEM).

Do Hedge Funds Think AEM Is A Good Stock To Buy Now?

At the end of December, a total of 36 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 29% from the previous quarter. On the other hand, there were a total of 34 hedge funds with a bullish position in AEM a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Agnico Eagle Mines Limited (NYSE:AEM) was held by Renaissance Technologies, which reported holding $150.2 million worth of stock at the end of December. It was followed by Arrowstreet Capital with a $74.4 million position. Other investors bullish on the company included Waratah Capital Advisors, Sprott Asset Management, and Sloane Robinson Investment Management. In terms of the portfolio weights assigned to each position Sloane Robinson Investment Management allocated the biggest weight to Agnico Eagle Mines Limited (NYSE:AEM), around 14.07% of its 13F portfolio. Waratah Capital Advisors is also relatively very bullish on the stock, dishing out 2.36 percent of its 13F equity portfolio to AEM.

Now, key hedge funds were breaking ground themselves. Balyasny Asset Management, managed by Dmitry Balyasny, created the most outsized position in Agnico Eagle Mines Limited (NYSE:AEM). Balyasny Asset Management had $12.5 million invested in the company at the end of the quarter. Rob Citrone’s Discovery Capital Management also initiated a $7.1 million position during the quarter. The other funds with brand new AEM positions are Warren Lammert’s Granite Point Capital, Peter Galgay’s Amitell Capital, and Joel Greenblatt’s Gotham Asset Management.

Let’s also examine hedge fund activity in other stocks similar to Agnico Eagle Mines Limited (NYSE:AEM). These stocks are Cheniere Energy Partners LP (NYSE:CQP), ONEOK, Inc. (NYSE:OKE), DISH Network Corp. (NASDAQ:DISH), Insulet Corporation (NASDAQ:PODD), Western Digital Corporation (NASDAQ:WDC), IAC/InterActiveCorp (NASDAQ:IAC), and Royal Caribbean Cruises Ltd. (NYSE:RCL). This group of stocks’ market valuations match AEM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CQP | 4 | 9283 | 1 |

| OKE | 22 | 105420 | 2 |

| DISH | 57 | 2021289 | -3 |

| PODD | 41 | 1418120 | 3 |

| WDC | 44 | 1296703 | 5 |

| IAC | 67 | 2230707 | -5 |

| RCL | 37 | 554165 | 7 |

| Average | 38.9 | 1090812 | 1.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 38.9 hedge funds with bullish positions and the average amount invested in these stocks was $1091 million. That figure was $389 million in AEM’s case. IAC/InterActiveCorp (NASDAQ:IAC) is the most popular stock in this table. On the other hand Cheniere Energy Partners LP (NYSE:CQP) is the least popular one with only 4 bullish hedge fund positions. Agnico Eagle Mines Limited (NYSE:AEM) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for AEM is 65.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 7.9% in 2021 through April 1st and surpassed the market again by 0.4 percentage points. Unfortunately AEM wasn’t nearly as popular as these 30 stocks (hedge fund sentiment was quite bearish); AEM investors were disappointed as the stock returned -14.9% since the end of December (through 4/1) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 30 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Agnico Eagle Mines Ltd (NYSE:AEM)

Follow Agnico Eagle Mines Ltd (NYSE:AEM)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.