We recently published a list of 15 Most Promising Technology Stocks to Buy Now. In this article, we are going to take a look at where Advanced Micro Devices, Inc. (NASDAQ:AMD) stands against other most promising technology stocks to buy now.

The global technology sector is on track for strong earnings growth in 2025, driven by advancements in artificial intelligence (AI), cloud computing, and semiconductors. Despite macroeconomic uncertainties, tech companies have demonstrated resilience, leveraging innovation to sustain revenue and profit expansion. Analysts anticipate substantial earnings growth across the sector, reflecting solid fundamentals and continued investment in transformative technologies.

According to a December 2024 report by John Butters, Vice President and Senior Earnings Analyst at FactSet, earnings for the S&P 500 are expected to grow by approximately 15% in 2025, with the information technology (IT) sector playing a crucial role in this expansion. Notably, all eleven sectors of the S&P 500 are projected to see year-over-year earnings growth, with six—including IT—expected to achieve double-digit increases. The report also emphasizes an interesting shift which is occurring outside of the “Magnificent 7,” the group of mega-cap tech companies that have historically driven market performance. While analysts forecast a 21% earnings growth for the Magnificent 7 in 2025, they also predict a significant improvement in earnings for the other 493 companies in the S&P 500, projecting a 13% increase. This represents a considerable jump from the mere 4% earnings growth expected for these same companies in 2024, signaling broader market participation in 2025.

Shifting Investor Focus Beyond Mega-Cap Tech

Although the Magnificent 7 continue to dominate the market, investor sentiment suggests a growing shift toward smaller, high-growth tech firms. Gene Munster, Managing Partner at Deepwater Asset Management, highlighted in a recent CNBC interview that while large-cap tech remains fundamentally strong, smaller companies within the “frontier tech” sector—typically valued below $500 billion—are poised to outperform over the next few years. This shift stems from concerns that trillion-dollar companies may have limited potential for high-percentage gains, prompting investors to explore smaller opportunities in AI, cloud infrastructure, and semiconductor equipment manufacturing.

A report from Deloitte’s 2025 Technology Industry Outlook reinforces the growth trajectory of the sector. Despite economic headwinds, technology investments are expected to accelerate, with increased spending on AI, cybersecurity, and enterprise software. Cybersecurity will be a critical focus as the digital attack surface expands due to the rise of IoT, generative AI, and cloud adoption. The global cost of cybercrime is projected to reach a staggering $10.5 trillion in 2025, emphasizing the need for heightened security investments.

Conclusion

As the technology sector heads into 2025, robust earnings growth is expected to continue, supported by AI-driven innovations and expanding digital transformation initiatives. The massive capital expenditures recently announced by major tech companies reflect confidence in the sector’s long-term potential. However, while mega-cap tech remains a dominant force, investor focus may increasingly shift toward smaller, high-growth companies that are pioneering next-generation technologies.

Our Methodology

To determine the 15 most promising technology stocks, we began by analyzing all U.S.-listed tech companies with a market capitalization of at least $2 billion. To exclude unprofitable companies, we considered only companies that reported a positive net profit margin over the trailing twelve months period. From this refined list, we further narrowed our selection to those stocks with a potential upside of more than 10%. Finally, we ranked the companies in ascending order based on the number of hedge funds holding stakes in the respective company, with the company attracting the most hedge fund interest securing the top spot.

Note: All pricing data is as of market close on February 17.

At Insider Monkey we are obsessed with the stocks that hedge funds pile into. The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

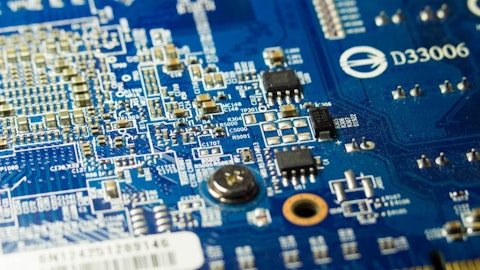

A close up of a complex looking PCB board with several intergrated semiconductor parts.

Advanced Micro Devices Inc. (NASDAQ:AMD)

Number of Hedge Funds: 107

Potential Upside: 24%

Advanced Micro Devices, Inc. (NASDAQ:AMD) is a semiconductor company that designs and manufactures high-performance computing and graphics solutions. Its product portfolio includes microprocessors, graphics processors, and system-on-chip (SoC) solutions for various applications, including data centers, gaming, and embedded systems. It has gained significant market share in the CPU and GPU markets, competing directly with Intel Corp. (NASDAQ:INTC) and NVIDIA Corp. (NASDAQ:NVDA).

Advanced Micro Devices, Inc. (NASDAQ:AMD)’s innovative architecture and focus on energy efficiency have established it as a key player in the rapidly evolving semiconductor industry. It is well-positioned to capitalize on the growing demand for high-performance computing, driven by trends such as artificial intelligence, machine learning, and cloud computing. That being said, there were news reports recently of Arm Holdings Plc. (NASDAQ:ARM)’s plan of launching its own chips this year after securing Meta Platforms (NASDAQ:META) as one of its first customers. If these reports hold water, competition will intensify further for both Advanced Micro Devices Inc. (NASDAQ:AMD) and Intel Corp. (NASDAQ:INTC).

In the first week of January, Northland Capital Markets analyst Gus Richard named Advanced Micro Devices Inc. (NASDAQ:AMD) among his Top Picks for 2025. He estimates the company’s AI revenue to reach $9.5 billion in 2025, up from $5.2 billion, with revenue in the first half of 2025 expected to rise 7% compared to the second half of 2024. He provides a positive rationale, stating:

“We expect AMD to continue to gain share in AI GPUs, server CPUs, and PC clients as headwinds from the embedded and gaming segments abate. AMD is winning share in AI based on its roadmap and TCO. AMD has better products for server and client CPUs. The PC refresh cycle will likely be much stronger than currently expected. We think there is significantly more upside to CY 2025 than risks.”

In a February 5 update, a Stifel analyst maintained his Buy rating on Advanced Micro Devices Inc. (NASDAQ:AMD) but lowered his target price to $162 from $200 earlier, still indicating 43% upside.

Overall, AMD ranks 3rd on our list of most promising technology stocks to buy now. While we acknowledge the potential of AMD to grow, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than AMD but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and Complete List of 59 AI Companies Under $2 Billion in Market Cap

Disclosure: None. This article is originally published at Insider Monkey.