Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 900 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Adient plc (NYSE:ADNT).

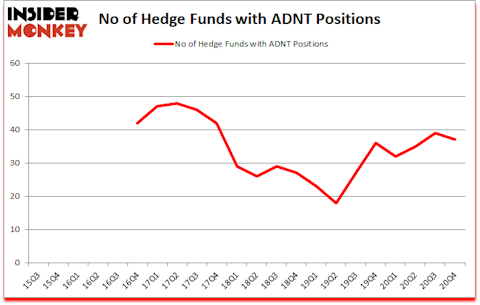

Is ADNT stock a buy? Adient plc (NYSE:ADNT) was in 37 hedge funds’ portfolios at the end of December. The all time high for this statistic is 48. ADNT has seen a decrease in hedge fund sentiment recently. There were 39 hedge funds in our database with ADNT positions at the end of the third quarter. Our calculations also showed that ADNT isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 124 percentage points since March 2017 (see the details here).

Ryan Tolkin, CIO of Schonfeld Strategic Advisors

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 10 best battery stocks to buy to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now we’re going to take a peek at the recent hedge fund action encompassing Adient plc (NYSE:ADNT).

Do Hedge Funds Think ADNT Is A Good Stock To Buy Now?

At fourth quarter’s end, a total of 37 of the hedge funds tracked by Insider Monkey were long this stock, a change of -5% from the previous quarter. The graph below displays the number of hedge funds with bullish position in ADNT over the last 22 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Andrew Wellington and Jeff Keswin’s Lyrical Asset Management has the number one position in Adient plc (NYSE:ADNT), worth close to $190.2 million, comprising 2.6% of its total 13F portfolio. The second most bullish fund of Renaissance Technologies, with a $59.3 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining professional money managers that are bullish include Jonathan Kolatch’s Redwood Capital Management, Edgar Wachenheim’s Greenhaven Associates and Ari Zweiman’s 683 Capital Partners. In terms of the portfolio weights assigned to each position Newtyn Management allocated the biggest weight to Adient plc (NYSE:ADNT), around 7.05% of its 13F portfolio. Elm Ridge Capital is also relatively very bullish on the stock, earmarking 5.26 percent of its 13F equity portfolio to ADNT.

Because Adient plc (NYSE:ADNT) has witnessed bearish sentiment from the entirety of the hedge funds we track, it’s safe to say that there exists a select few hedgies that decided to sell off their positions entirely by the end of the fourth quarter. It’s worth mentioning that Sander Gerber’s Hudson Bay Capital Management cut the biggest stake of all the hedgies watched by Insider Monkey, worth about $4.3 million in stock, and Dmitry Balyasny’s Balyasny Asset Management was right behind this move, as the fund sold off about $4.1 million worth. These moves are intriguing to say the least, as total hedge fund interest was cut by 2 funds by the end of the fourth quarter.

Let’s also examine hedge fund activity in other stocks similar to Adient plc (NYSE:ADNT). These stocks are LCI Industries (NYSE:LCII), HMS Holdings Corp. (NASDAQ:HMSY), Arconic Corporation (NYSE:ARNC), Deciphera Pharmaceuticals, Inc. (NASDAQ:DCPH), AllianceBernstein Holding LP (NYSE:AB), Brighthouse Financial, Inc. (NASDAQ:BHF), and Ambarella Inc (NASDAQ:AMBA). All of these stocks’ market caps resemble ADNT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LCII | 16 | 124857 | -9 |

| HMSY | 26 | 239529 | 0 |

| ARNC | 24 | 904373 | 3 |

| DCPH | 36 | 673228 | 6 |

| AB | 9 | 39879 | 1 |

| BHF | 33 | 464270 | 7 |

| AMBA | 36 | 377357 | 2 |

| Average | 25.7 | 403356 | 1.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.7 hedge funds with bullish positions and the average amount invested in these stocks was $403 million. That figure was $651 million in ADNT’s case. Deciphera Pharmaceuticals, Inc. (NASDAQ:DCPH) is the most popular stock in this table. On the other hand AllianceBernstein Holding LP (NYSE:AB) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Adient plc (NYSE:ADNT) is more popular among hedge funds. Our overall hedge fund sentiment score for ADNT is 76.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks returned 7.9% in 2021 through April 1st but still managed to beat the market by 0.4 percentage points. Hedge funds were also right about betting on ADNT as the stock returned 24% since the end of December (through 4/1) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Adient Plc (NYSE:ADNT)

Follow Adient Plc (NYSE:ADNT)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.