The fourth quarter was a rough one for most investors, as fears of a rising interest rate environment in the U.S, a trade war with China, and a more or less stagnant Europe, weighed heavily on the minds of investors. Both the S&P 500 and Russell 2000 sank as a result, with the Russell 2000, which is composed of smaller companies, being hit especially hard. This was primarily due to hedge funds, which are big supporters of small-cap stocks, pulling some of their capital out of the volatile markets during this time. Let’s look at how this market volatility affected the sentiment of hedge funds towards Acorda Therapeutics Inc (NASDAQ:ACOR), and what that likely means for the prospects of the company and its stock.

Hedge fund interest in Acorda Therapeutics Inc (NASDAQ:ACOR) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Denny’s Corporation (NASDAQ:DENN), Kelly Services, Inc. (NASDAQ:KELYA), and InfraREIT Inc (NYSE:HIFR) to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to view the new hedge fund action encompassing Acorda Therapeutics Inc (NASDAQ:ACOR).

What have hedge funds been doing with Acorda Therapeutics Inc (NASDAQ:ACOR)?

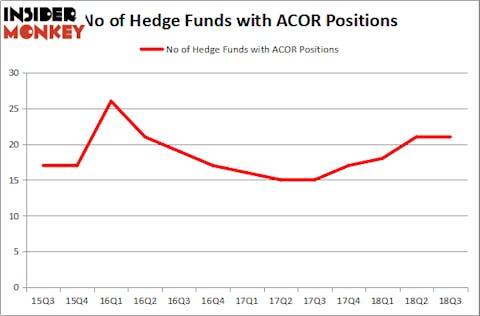

At Q3’s end, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ACOR over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Matt Sirovich and Jeremy Mindich’s Scopia Capital has the largest position in Acorda Therapeutics Inc (NASDAQ:ACOR), worth close to $139.7 million, corresponding to 2.7% of its total 13F portfolio. The second largest stake is held by Christopher James of Partner Fund Management, with a $33.4 million call position; the fund has 0.5% of its 13F portfolio invested in the stock. Some other professional money managers with similar optimism contain Jim Simons’s Renaissance Technologies, Christopher James’s Partner Fund Management and Israel Englander’s Millennium Management.

Because Acorda Therapeutics Inc (NASDAQ:ACOR) has experienced declining sentiment from the entirety of the hedge funds we track, it’s easy to see that there lies a certain “tier” of hedgies that elected to cut their positions entirely in the third quarter. Intriguingly, Julian Baker and Felix Baker’s Baker Bros. Advisors dropped the biggest investment of the “upper crust” of funds monitored by Insider Monkey, totaling close to $5 million in call options, and Jeffrey Jay and David Kroin’s Great Point Partners was right behind this move, as the fund said goodbye to about $4.2 million worth. These bearish behaviors are interesting considering the fact that ACOR’s biggest holder Scopia Capital reported selling more then 600K shares the stock at prices as low as $16.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Acorda Therapeutics Inc (NASDAQ:ACOR) but similarly valued. These stocks are Denny’s Corporation (NASDAQ:DENN), Kelly Services, Inc. (NASDAQ:KELYA), InfraREIT, Inc. (REIT) (NYSE:HIFR), and Kenon Holdings Ltd. (NYSE:KEN). This group of stocks’ market caps resemble ACOR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DENN | 22 | 144891 | 4 |

| KELYA | 7 | 7527 | -4 |

| HIFR | 14 | 112590 | -2 |

| KEN | 1 | 1562 | 0 |

| Average | 11 | 66643 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $67 million. That figure was $226 million in ACOR’s case. Denny’s Corporation (NASDAQ:DENN) is the most popular stock in this table. On the other hand Kenon Holdings Ltd. (NYSE:KEN) is the least popular one with only 1 bullish hedge fund positions. Acorda Therapeutics Inc (NASDAQ:ACOR) is not the most popular stock in this group. Its biggest holder has been dumping ACOR shares in recent days and actually a large number of hedge funds are shorting the stock (more than 8 million shares of ACOR are sold short at the end of November). As a result, we don’t think ACOR is a good stock to buy right now and we may be inclined to short it.

Disclosure: None. This article was originally published at Insider Monkey.